Value of IP mash-up takes spotlight in Michael Jackson case

The trial involving the Michael Jackson estate has started in Tax Court in California. One of the issues in the case is the fair market value of Jackson’s posthumous right of publicity, which includes his name and image. The estate valued this at $2,105 because the pop star was mired in scandal at the time of his death. The IRS disagrees and puts the value at $434 million.

In a pretrial motion, the estate asked the court to exclude the valuation report by intellectual property expert Weston Anson (CONSOR) for several reasons. One is that Anson included values for “extremely speculative” ventures such as a Michael Jackson theme park. But the biggest objection is that the report values a combination (mash-up) of different rights, which the estate says violates a requirement that every item of property be valued separately.

Report allowed: U.S. Tax Court Judge Mark Holmes ruled that Anson’s report should not be excluded. “This is an especially interesting legal question," writes Holmes in his order. "In a world without transaction costs, it wouldn't matter if publishing rights, performance royalties, trademarks, etc. were valued separately because a rational buyer would value them as if they could be put together in the most profitable way even if they were bought separately. But it is entirely possible that trial will show that these separate rights would be more valuable if used together. If so, and if the Estate owned these separate rights, it might well be the case that they are worth more together than they would be if summed separately."

You can read the entire order if you click here. Stay tuned for more on this case!

back to top

Alerding comments on Washington state double-dip analysis

A recent double-dip decision out of Washington state prompted a reader’s request for comment from veteran valuator Jim Alerding (Alerding Consulting), who frequently deals with divorce-related valuation issues.

In In re Marriage of Cheng, the trial court determined that the nonbusiness owner spouse (wife in this case) was entitled to maintenance payments totaling about $640,000 over 44 months. The husband appealed, claiming that those payments in essence “came from” the value of the business after the wife had already received half of the business’s value in the division of property. The business was valued under an income approach.

The state Court of Appeals disagreed. It found that, for purposes of determining the owner spouse’s ability to pay maintenance, the trial court could consider all income—in this case, about $925,000 per year. According to Alerding, the theory of the court is the husband is awarded the business, which distributes about $925,000 annually to him out of which he can pay maintenance without diminishing the value of the company. All else being equal, the company retains its value of $3.6 million at the end of each year.

Not a wasting asset: Alerding says it is a curious anomaly that this occurs. He explains that, under a discounted cash flow analysis, as each year ends, each year in the now new DCF moves one year closer to the current value. Because of the diminishing value in the far out years (it is an infinity calculation in the terminal value), the overall value remains the same, again all other things being the same. Technically speaking, Alerding says, this particular business—and any business so valued—is not a wasting asset; therefore, using any of its (distributed) income to pay maintenance would not impede the value of the business. Extending that theory, there would not be a case where a “double dip” could occur.

Or, as the Court of Appeals in Cheng put it: “Because FFM generates net profit from its operations for Victor to receive as income without decreasing its value, this case does not involve double recovery for Julia. Victor will have close to $925,000 annually available to pay maintenance and despite this distribution of income FFM will retain its $3.6 million value. Therefore, we reject Victor's double recovery argument.”

Note of caution: Alerding notes this construct may be unique to Washington state. Double dipping, like goodwill, is an issue that states have handled differently. Consequently, other states may very well take the view that any invasion into the future income that has already been distributed as part of the value of the business would indeed be a double dip. Valuators need to inform themselves of the double-dip jurisprudence the court in front of which they practice has developed, Alerding cautions.

The case is In re Marriage of Cheng, 2016 Wash. App LEXIS 2854 (Nov. 22, 2016). A digest of the case and the court’s opinion are available here.

Extra: Alerding and Sylvia Golden, BVR’s legal editor, recently discussed other valuation-related cases during a webinar, BVLaw Case Update: A One-Hour Briefing. You can access a replay if you click here.

back to top

Damodaran puts high value on narrative

Dr. Aswath Damodaran (Stern School of Business, New York University) has often talked about the dangers of using numbers without any narrative when constructing valuations. Now, he has put all of his thoughts together in his own narrative.

New book: Damodaran’s new book, Narrative and Numbers: The Value of Stories in Business, is available here. One danger of too much emphasis on numbers is that valuations become “plug-and-point exercises, tools to advance sales pitches or confirm pre-conceived values,” he says. A valuation needs a marriage of narrative and numbers. “In a good valuation, the numbers are bound together by a coherent narrative, and storytelling is kept grounded with numbers,” he says.

In fact, it is this combination of narrative and numbers that attracted Damodaran to valuation in the first place, he told Business Valuation Update in an interview. “I didn’t want to become an accountant. It’s too numbers-driven for me. I didn’t want to be a strategist because it’s too much storytelling. So in a sense, I wanted something that would help me expand the creative component of business—coming up with great valuation ideas with discipline. So that’s what always attracted me to valuation. Not the model-building, not the spreadsheets, not the number-crunching, and not the accounting.”

He continues: “It’s a fact that if you do a good valuation, it’s like composing a tune, and the tune should actually sound good. So it forces you if you’re a storyteller to be disciplined. And it forces you if you’re a numbers person to think about the narrative. And to me that’s an exciting place to be.”

back to top

Tech IPOs have lost value

A third of tech companies that have had IPOs in the last decade are now trading beneath their initial valuation, according to analytics firm Geckoboard. The underperforming companies include Twitter, which was worth $24 billion at the end of its first day on the stock market and is now worth half that as it keeps looking for a buyer. Other “notorious flame-outs” include mobile game company Zynga, which has lost 66% off its IPO value after floating at $6.6 billion in 2011.

back to top

Cannabiz multiples may be rising

Viridian Capital Advisors, a strategic and financial advisory firm dedicated to the legal marijuana industry, has a stock index that tracks the performance of about 50 publicly traded cannabis companies as a proxy for the industry. You can see price-to-sales multiples from 2015 up to the third quarter of 2016 here. “For the last quarter of 2016, we expect multiples to have risen again driven by further increases in stock prices,” says Harrison Phillips, an analyst at Veridian.

One of the key issues for a legal marijuana firm is licensing. Cannabiz Media and BVR co-publish the Marijuana Licensing Reference Guide. This guide provides the most comprehensive look at state-by-state marijuana licensing along with in-depth analysis of 10 critical factors that affect businesses in the cannabis industry.

back to top

Global BV News

Global trademark values of law and accounting firms

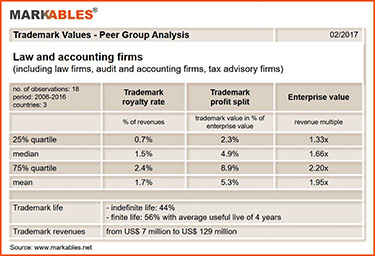

In recent months, M&A and valuation interest in professional service firms have been increasing. Until now, relatively very little is known about the importance and value of brand names for these types of firms. The exhibit below illustrates typical royalty rates and trademark values found in the transactions of 18 different accounting and law firms between 2006 and 2016, according to data from MARKABLES, a Switzerland firm that has a database of over 8,200 global trademark valuations published in financial reporting documents of listed companies.

A secondary asset: The price-to-sales multiples paid for professional service firms are typically in the range of between 1.5x and 2x revenues. It is obvious that the brand name plays a secondary role. There are primary assets to consider first. Customer relationships depend on the nature of the business. Repeat business, such as annual audits, ongoing bookkeeping, or IP administration and management, means high customer value. On the other hand, project-related business such as advisory or litigation support indicates a higher reputational and brand value. Of course, key people are another element to consider. If key people leave the firm, will their clients and business stay with the firm or will they take it with them?

Depending on the nature of these primary assets, the brand name is more or less important. Accordingly, the data show trademark royalty rates between 1% and 2.5% and brand names accounting for 5% of firm value on average. An analysis of remaining useful life (RUL) is also worth noting. Over 50% of acquired firms have finite and rather short RULs, which means that the acquirer intends to replace the firm’s name in the near future.

The upshot here is that project-based professional services firms in particular should focus on both their reputational value and on key advisor retention to increase their value.

(click image to view full size)

back to top

|

Preview of the March 2017 issue of Business Valuation Update

Here’s what you’ll see:

- “The Residual Contribution Method for Valuing a Corporate Brand” (René Hlousek, Beacon Valuation Group LLC). In 2004, the author published a paper that introduced a new school of thought to the valuation of a corporate brand. This has since evolved into a method he refers to as the residual contribution method (RCM), which he explains in this article, on which feedback is encouraged and welcome.

- “Review: Discount for Lack of Marketability Guide and Toolkit” (Harold G. Martin Jr., Keiter). BVU was able to arrange for a “sneak preview” of a soon-to-be released “groundbreaking” calculator for a discount for lack of marketability based on restricted stock transactions. The model also incorporates option methodology and includes a qualitative factors assessment tool.

- “Fair Value Experts Offer Their Insights on ASC 805” (BVR Editor). The launch of the new Certified in Entity and Intangibles Valuation, or CEIV, credential has thrust the issue of fair value into the spotlight. Mark Zyla (Acuitas) and Nathan DiNatale (SC&H) give an overview of ASC 805 on business combinations that is an excerpt from a new guide to purchase price allocations to which they generously contributed.

- “Final IVS 2017 Seeks to Standardize Conduct and Approach to Global Valuation” (BVR Editor). The International Valuation Standards Council (IVSC) has released IVS 2017, its latest set of standards that aim to bring more consistency to valuation practices across the world.

- “Business Valuation Industry in India Is Poised for Sustained Growth” (Bharat Kanodia, ASA, Veristrat Inc.). First in a series of articles detailing the state of the business valuation industry in India. This article gives an overview of the current valuation market in India, including the provision of outsourced valuation services.

The issue also includes:

- Regular features: “BV News At-a-Glance/Global Perspective,” “Ask the Experts,” and “Tip of the Month.”

- BV data spotlight: Pratt’s Stats MVIC/EBITDA Trends, ktMINE Royalty Rate Data, Economic Outlook for the Month, and Cost of Capital Center.

- BVLaw Case Update: The latest court cases that involve business valuation issues.

To stay current on business valuation, see the March issue of Business Valuation Update.

back to top

Nominations open for NACVA’s 40 Under Forty honorees

Do you know someone in the business valuation, financial litigation, or related profession who is 40 years of age or under and has what it takes to be part of the “next generation of industry mavericks?” If so, consider submitting his or her name to NACVA for its 2017 40 Under Forty honors. Nominees do not need to be affiliated with NACVA. To submit a name for consideration, click here. The deadline is March 31, 2017.

back to top

BV movers . . .

People: Gregory Clark, a senior manager at CLH of Michigan City, Ind., completed the CVA certification process … CBIZ Tofias promoted Brendan Donovan to managing director. He’ll work out of both the Providence, R.I., and Boston offices … Millard Martin of Shinn & Co. in Bradenton, Fla., received the ABV credential … Ryan Weber has been admitted as partner at MBE CPAs in Baraboo, Wisc.

Firms: The St. Louis Business Journal named Anders CPAs + Advisors a “2017 Best Places to Work” finalist … BKD of Springfield, Mo., was named to Training magazine’s “Top 125” list … Cogence Group PC of Portland, Ore., just celebrated its 10th anniversary. The firm recently added two new associates who are both CPAs and former auditors with Ernst & Young … EisnerAmper collected several Best of 2016 New Jersey Law Journal Awards, including first place in the categories of Best Economic Damages Valuation Provider and Best Matrimonial Valuation Provider … Grant Thornton International has expanded operations in three countries, with the acquisitions of Confida Banja Luka in Banja Luka, Bosnia, Interbilanz Croatia in Zagreb, and Interbilanz Slovenia in Ljubljana and Celje.

Please send your professional and firm news to us at editor@bvresources.com.

back to top

CPE events

Promoting Quality in Providing Fair Value Measurements for Financial Reporting (February 22), with Anthony Aaron (University of California).

Social Media: Who Owns It and What Is It Worth? (February 23), with Mark Zyla (Acuitas).

Valuing Banks: Day 1 Fundamentals (February 28), with Keith Sellers (University of Denver). Part 2 of BVR's Special Series on Banking and Financial Services.

Valuing Banks: Day 2 Case Study (March 1), with Keith Sellers (University of Denver). Part 3 of BVR's Special Series on Banking and Financial Services.

Important note to webinar attendees: To ensure that you receive your dial-in instructions to BVR’s training events, please make sure to whitelist bvreducation@bvresources.com.

back to top

|

We welcome your feedback and comments. Contact Andy Dzamba (Executive Editor) or Sylvia Golden (Executive Legal Editor) at:

info@bvresources.com. |