Opposing responses to New Jersey DLOM ruling

In valuing the oppressing shareholder’s (seller’s) interest in a closely held family business, a New Jersey trial court, in line with precedent, recently decided it was appropriate to apply a 25% discount for lack of marketability because the seller’s conduct had created an “extraordinary circumstance,” i.e.,forcing a buyout.

Responding to Michelle Patterson’s earlier critique of the New Jersey courts’ use of "carefully developed valuation concepts and measures as tools of punishment or reward in fair value litigations,” Wayne (Nick) Nichols (Abrams Little-Gill Loberfeld PC) agrees the practice is problematic. Nichols says: “The court is now expecting valuators to become the judge with the responsibility to determine the appropriate DLOM penalty to be assessed in future cases! That should not be our responsibility. Our job is to provide a fair and reasoned valuation to the court, including a clear explanation of the facts and how we applied valuation principles to reach our conclusion. Period.”

Jim Alerding (Alerding Consulting) sees the issue differently. "Actually what is being done here and in other similar cases is the court is using its authority to decide whether a DLOM should be applied in the case of a fair value case,” Alerding says. He notes that the comments to the ABA’s Model Business Corporation Act provide: “In cases where there is dissension but no evidence of wrongful conduct, ‘fair value’ should be determined with reference to what the petitioner would likely receive in a voluntary sale of shares to a third party, taking into account his minority status.” MBCA, § 14.34 comm. 4(b). Alerding concludes: "So the application of DLOMs in these cases is not a distortion of valuation principles but instead is an application of law as to whether or not, with the facts presented, the wrongful conduct of the minority shareholder requires the application of a DLOM. It is not an issue of valuation principles. In fact, courts are empowered to change principles in valuation or otherwise (unless restricted by law from doing so) when they see fit."

back to top

Is trail income goodwill? Tennessee divorce court examines

A Tennessee divorce dispute centering on a financial planning practice raised the issue of what to do with the “trail” income—the money a sole proprietor makes from the ongoing management of his clients’ accounts. Conceptually, is it like professional goodwill or is it a marital asset subject to distribution?

The husband’s business generated direct commissions from the sale of financial products as well as trail income. At trial, the husband conceded that, unlike the goodwill in his practice, he could sell the trail income separately for two times its annual value; in case of disability or death, he also could assign the trail income to another professional, in which case the assignee might pay the family a certain percentage of the annual earnings.

After the trial court had found that the trail income was a marital asset and awarded the wife half of its value, the husband appealed. He claimed the trail income was no different from the professional goodwill found in a solo practice, which under state law was not a marital asset. The Court of Appeals disagreed, noting that “[i]n contrast to professional goodwill, [the husband’s] trail income could be sold separately.” There also was a methodology in the industry for valuing such trail income as sellable property, the court noted. But, in reviewing the husband’s objection to the trial court’s child and spousal support findings, the Court of Appeals noted a double-counting issue. The trial court, in its income determination, appeared to have included the trail income that it had distributed as a marital asset, the reviewing court noted. To do so was improper under the applicable statutory provision, the appeals court found.

Consequently, the Court of Appeals vacated the support determinations and ordered the trial court to recalculate the father’s income, excluding the trail income distributed as a marital asset. But, said the appeals court, the trial court “should consider, however, any additional income generated by this asset after the division.”

The case is Fuller v. Fuller, 2016 Tenn. App. LEXIS 974 (Dec. 21, 2016). A digest of the decision and the court’s opinion will be available soon at BVLaw.

back to top

Need an official definition of ‘personal goodwill’? It doesn’t exist.

During a recent webinar on the double-dip phenomenon in a valuation for divorce, the point was made that there is no generally accepted definition for the term “personal goodwill.” An audience member asked: “How can that be? It can be such an important issue.” One of the speakers, Rob Levis (Levis Consulting), pointed out that it does not show up in the International Glossary of Business Valuation Terms. “You can find goodwill, but not personal goodwill,” he noted. It’s also not in the glossary from the International Valuation Standards Council.

Levis pointed out that there is an entire chapter devoted to the search for a definition of personal goodwill in BVR's Guide to Personal v. Enterprise Goodwill, 5th edition. The chapter’s author, David Wood (Wood Forensic/Valuation Services), famous for his MUM framework for estimating personal goodwill, offers his definition, which sounds good to us:

Personal goodwill is the value of earnings or cash flow attributable to attributes of the individual that results in earnings from consumers that return because of the individual, in earnings from new customers who seek out the individual, and in earnings from referrals made to the individual.

Do you know of a good definition of personal goodwill? Let us know!

back to top

Are you skeptical enough?

One of the pitfalls in fair value measurements is a lack of professional skepticism when reviewing management’s prospective financial information (PFI), Mark O. Smith (AICPA) writes in a blog post. He points out that factors and common procedures to consider when preparing an assessment of a company’s PFI may include, but are not limited to:

- Comparison of prior forecasts to actual results;

- Comparison of PFI to industry expectations;

- Check PFI against other internally prepared financial information for consistency;

- Comparison of entity PFI to historical trends;

- Understand who prepares the PFI and how often is it prepared; and

- Perform mathematical and logic checks.

Smith is a technical author of the Mandatory Performance Framework for the new credential for fair value for financial reporting, which includes a section on “professional skepticism.”

back to top

Appraising the 'merger price' appraisal rule

In cases involving dissenting shareholders in a post-merger appraisal proceeding, courts sometimes benchmark fair value against the merger price itself. Applying principles of game theory and auction design, the authors of a paper demonstrate that doing this is “strategically equivalent to nullifying appraisal rights altogether.” The authors are Albert H. Choi (University of Virginia School of Law) and Eric L. Talley (Columbia University—School of Law). The merger price rule, generally, can “depress both acquisition prices and target shareholders’ expected welfare relative to both an optimal appraisal rule and several other plausible alternatives.”

Extra: “Appraisals Gone Wild” is an article from Stout Risius Ross that surveys all fair value appraisal rulings in Delaware since 2010. It identifies certain key metrics in those decisions, including the court’s valuation methodology, whether an auction or go-shop was included in the M&A transaction, and the mean and median premium over merger price resulting from those awards.

back to top

FASB issues two updates

The Financial Accounting Standards Board (FASB) issued a proposed accounting standards update intended to improve financial reporting for nonemployee share-based payments. The proposal would expand the scope of Topic 718, Compensation—Stock Compensation. The FASB would like comments on the proposal by June 5, 2017.

The FASB also released an accounting standards update to improve the presentation of defined benefit costs in the income statement. It requires a reporting organization to separate the service cost component from the other parts of the net benefit cost for presentation purposes. Effective date starts in 2018.

back to top

Attack spreads on property tax exemptions for nonprofit hospitals

Back in 2015, BVWire reported on what could be a growing trend of cash-strapped municipalities looking to revoke the property tax exemptions of nonprofit hospitals. Now at least one state is getting into the act. Connecticut is proposing to eliminate nonprofit hospitals’ property tax exempt status in its new budget, reports the New Canaan News. If it goes through, it would generate $212 million for state coffers. But, to compensate for the hospitals’ loss in revenue, the state would make available $250 million in Medicaid payments to the healthcare providers. Regardless, hospitals are protesting the planned action.

back to top

| Global BV News |

Trademark values of window and door brands

Some businesses are characterized by the difficulty of building long-term relationships with end users. This may be due to one-off or rare needs (i.e., construction services, building products, hospital services), and/or intermediaries with strong influence on vendor decisions (e.g., prescription drugs). Where repeat purchases from existing customers are difficult to achieve, it is vital to focus marketing efforts on both influencer marketing and on reputation marketing to create awareness for the one moment when the customer makes the purchase decision.

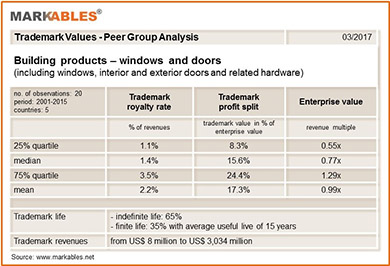

Such is the backdrop for an analysis of market-based intangible assets for a particular subsector of building products: windows and doors. MARKABLES, a Switzerland firm that has a database of over 8,200 global trademark valuations published in financial reporting documents of listed companies, analyzed the purchase price allocations of 20 acquisitions in that sector between 2001 and 2015 in five different countries. To begin with, revenue multiples range from 0.6x to 1.3x of revenues (see table below) and represent strong competition, limited growth expectations, and moderate profitability of the sector. Revenue multiples were higher in emerging countries with higher growth in building markets. All analyzed cases report a value of the acquired trade name, and 85% of the cases report a value for their customer relations (with wholesalers, installers, and/or architects/engineers).

Overall, trade names and customer relations have a very similar importance, with 15.6% and 15.4% of enterprise value. As for the trade name, the median royalty rate applied in the valuing is 1.4%, and the mean rate is 2.2%. Two-thirds of the acquired trade names are assigned an indefinite life, and one-third a finite life with an average RUL of 15 years. Goodwill accounts for 40% of enterprise value on average, indicating—among others—the potential synergies (cost savings, logistics, and cross-selling) expected from the business combination. But the most important asset of all is tangibles. Building products requires expensive factories, inventories, logistics, and customer receivables. And—for its moderate profitability—the excess value over book value that can be allocated to intangible assets is smaller than in many other sectors.

(click to view larger) (click to view larger)

back to top

|

Preview of the April 2017 issue of Business Valuation Update

Here’s what you’ll see:

- “Revisiting the Meaning of Fair Market Value” (Mark O. Dietrich). The author stimulates a rethinking of how fair market value is determined in a real-world transaction setting. Although he uses the healthcare sector to illustrate this, this applies in general across all industries.

- “Five Action Steps to Verify the Financials of a Cash Business” (Pasquale Rafanelli, Grassi & Co.).When performing a business valuation, there are areas that are always ripe for manipulation—especially if you’re dealing with a cash business. Here’s an in-the-trenches case of such a business and how the manipulation was substantiated.

- “ASA BV Chair Discusses Recent Changes to New FV Rules and CEIV” (BVR Editor). An interview with William Johnston (Empire Valuation Consultants LLC), chair of the ASA’s BV committee who is also the ASA’s CEIV program development representative and an instructor in the ASA’s first CEIV training course.

- “Using Monte Carlo to Value Warrants With Down-Round Protection” (Oksana Westerbeke and Jared Hannon, Grant Thornton LLP). An illustration of the valuation of a warrant with two different types of common ratchet provisions (full and half) in a company with a simple capital structure. The methodology and application apply equally to public and private companies with simple capital structures

- “Discovering the Drivers of Employee Equity Valuations” (Jason Murphy, Melbourne, Australia). This is the second in a number of articles on valuing employee equity, and it starts to examine the various forms of employee equity and the methodologies and standards for their valuation.

- “Seismic Shifts Underway in Business Valuation Practice in the U.K.” (Andrew Strickland, Scrutton Bland, U.K.). More refined techniques are now sweeping away ideas and methodologies surrounding business valuation that have held sway for decades in the United Kingdom.

- “Do Your Valuations Weigh Up?” (Chris Thorne, Bristol, U.K.). Two recent judicial decisions concerning very different assets situated in different jurisdictions illustrate that the courts prefer methods that provide the most detailed analysis of current or projected cash flow.

The issue also includes:

- Regular features: “BV News At-a-Glance/Global Perspective,” “Ask the Experts,” and “Tip of the Month.”

- BV data spotlight: Pratt’s Stats MVIC/EBITDA Trends, ktMINE Royalty Rate Data, Economic Outlook for the Month, and Cost of Capital Center.

- BVLaw Case Update: The latest court cases that involve business valuation issues.

To stay current on business valuation, look for the April issue of Business Valuation Update, which will be available online on Thursday morning.

back to top

BV movers . . .

People: Jim Brady, CEO of Grant Thornton, has been appointed to the U.S. Chamber of Commerce’s board of directors … Milton Kahn has been named principal of boutique investment bank The DAK Group of New Rochelle, N.J. … Buffalo, N.Y.-based Brisbane Consulting Group hired Kelly Mandell as a staff analyst responsible for valuation, forensic accounting, and litigation support services … Laura Mercandetti was named senior manager in the forensic accounting and litigation services group of Princeton, N.J.-based WithumSmith+Brown … Ernst & Young announced the appointment of Jane Steinmetz as managing principal of its Boston office and New England markets leader, effective June 1. Steinmetz is the first woman to hold a managing principal position in a Big Four company in the Boston area … Bill Thomas has been named global chairman of KPMG International. He’ll succeed John Veihmeyer on October 1.

Firms: Atlanta-based Aprio has added Yeager & Boyd, a CPA firm based in Birmingham, Ala. … Plante Moran of Southfield, Mich., was named to Fortune Magazine’s list of “100 Best Companies to Work For” for the 19th consecutive year … New York City-based Prager Metis has created a new technology company called Prager Metis Technology, to be led by Peter Fiorillo as president and CEO … Skoda Minotti of Cleveland was named a winner in the 2017 Smart Culture Awards and will be recognized at the 2017 Smart Culture Conference hosted by Smart Business on April 6 … UHY has opened an office in Houston, marking the Chicago-based accounting firm’s return to Texas.

Please send your professional and firm news to us at editor@bvresources.com.

back to top

CPE events

New Date: Valuing Hedge Funds (March 21), with Vladimir Korobov and Peter Rahe (Meyers, Harrison & Pia).

Valuing Undivided Interests in Real Estate (March 30), with Ted Israel (Israel Frey Group LLP).

New Date: Monte Carlo 101: Start Modeling in Excel (April 11), with John Elmore (Willamette Management Associates).

Regression Analysis: Fundamentals for Appraisers (April 20), with G. William Kennedy (FTI Consulting).

Advanced Bankruptcy Valuation (April 27), with Robert Reilly (Willamette Management Associates).

Important note to webinar attendees: To ensure that you receive your dial-in instructions to BVR’s training events, please make sure to whitelist bvreducation@bvresources.com.

back to top

|

We welcome your feedback and comments. Contact Andy Dzamba (Executive Editor) or Sylvia Golden (Executive Legal Editor) at: info@bvresources.com. |