|

|

BVWire is your go-to source for the latest in the business valuation profession. Highlights for this week include:

|

More takeaways from NACVA’s ‘super conference’

Last week’s issue had some takeaways from the Business Valuation & Financial Litigation Super Conference hosted by NACVA in Salt Lake City August 17-19. Here are some more “super” takeaways:

- During a Zoom trial, put the screens for the judge and your attorney right under your camera—that way, you’ll be looking at them when you speak;

- “Something fresh and new every day” is how one young practitioner describes his work as a valuation expert;

- Getting involved in the profession (e.g., volunteering on committees) sets you apart—and helps the profession;

- Think outside the box when doing compensation valuation for healthcare—a lot of the survey data are from a “fee-based” world, which has changed to “value-based”;

- The “war for talent” is “tremendous” and will continue for the next five to 10 years;

- Very few hands went up when asked whether they knew about the new international BV glossary (they couldn’t have been readers of BVWire!);

- Inexpensive online valuation calculators “have their place,” and speakers likened them to using WebMD versus going to a doctor—for something serious, you need to see a practitioner;

- More than ever, real estate appraisers are getting into going-concern valuations;

- Yes, judges “gossip” among themselves about testifying experts “all the time”;

- The “sweet spot” for long-term growth rates is currently 3% to 5% (for short term, check the subject company’s industry)—and check out free research (e.g., Livingston Survey, government sources);

- More U.S. companies are switching their supply chains from offshore to their home turf—even though it costs more;

- Using restricted stock to estimate a discount for lack of marketability is “hocus pocus,” and someday judges will figure that out;

- Someday, the “profession will have to figure out” what rate should be used when tax affecting—corporate or individual; and

- Talk to business brokers—one top valuation expert did that and had to redo his entire valuation.

There’s way too much more to include here, so we’ll have a detailed recap in the October issue of Business Valuation Update. |

|

Expert’s testimony excluded regarding licensing tattoos to video games

In a copyright infringement case in federal court in Ohio, a tattoo artist sued a video game company for depicting NBA players adorned with his copyrighted tattoos. The defendants argued that their use of the tattoos fell under the “fair use” rules, but the court noted that one of the factors to be considered was the “effect of the use upon the potential market for or value of the copyrighted work.” There were currently no incidences of tattoo artists licensing their designs for video games. The plaintiff brought in an expert from a large global consulting firm who was to testify on various matters, including whether the defendants benefited financially from reproduction of the tattoo designs. The expert was also to testify as to the likelihood of new markets forming, but, in a Daubert challenge, the court ruled that he was outside his area of expertise when he opined about the inevitable potential market for the licensing of tattoos for video games. The court excluded any testimony by the expert in regard to that but allowed his testimony on other matters.

The case is Hayden v. 2k Games, Inc., 2022 U.S. Dist. LEXIS 139184, and a case analysis and full opinion are available on the BVLaw platform. |

|

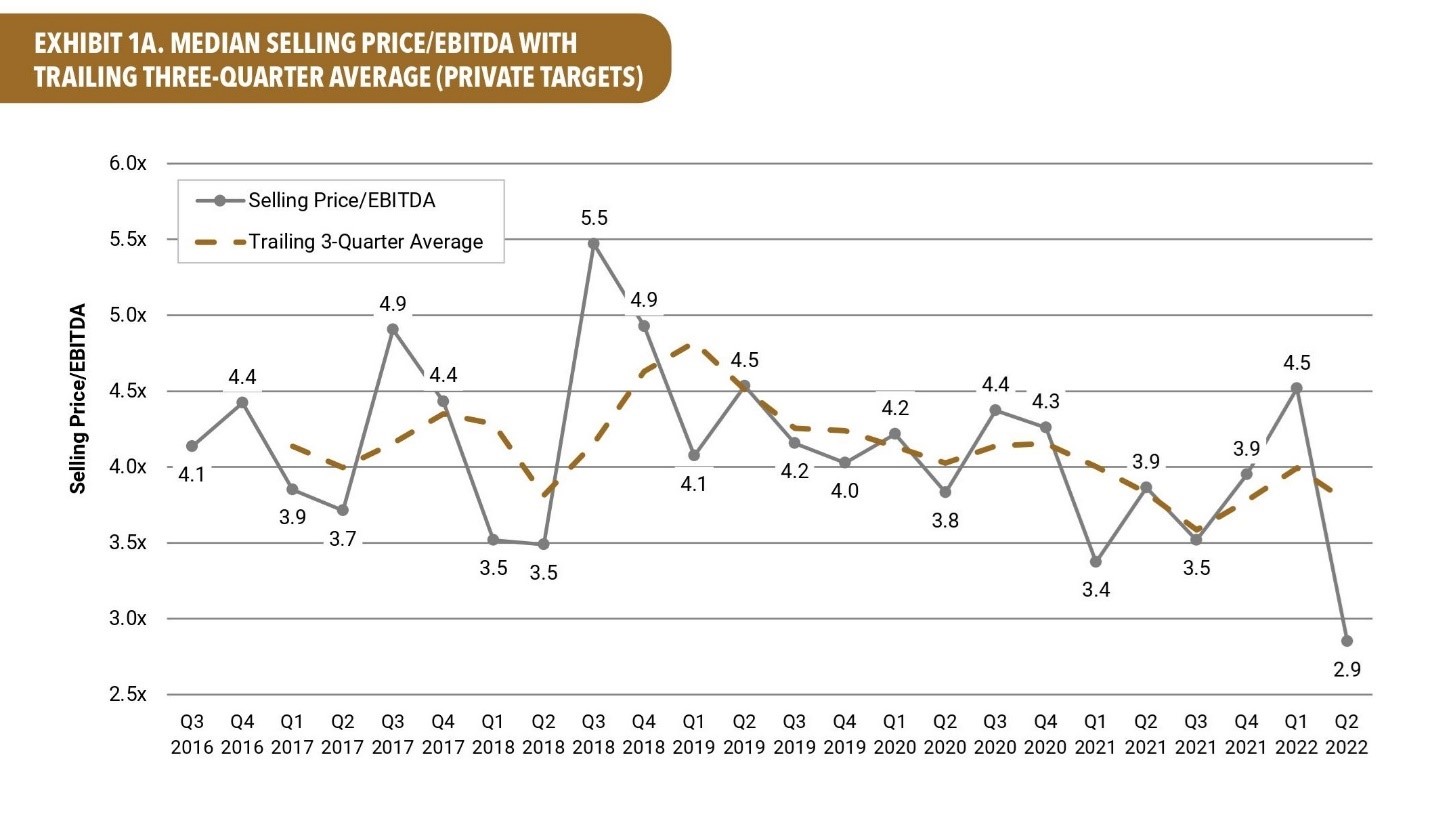

SME transaction values drop to 2.9x for 2Q2022

EBITDA multiples are at 2.9x for the second quarter of 2022, which is down from the 4.5x rate in the first quarter of 2022, according to the latest issue of the DealStats Value Index (DVI). The DVI calculates valuation multiples and profit margins from closely held companies each quarter, as shown in the chart below, which also highlights the median selling price/EBITDA with the trailing three-quarter average over a five-year period.

|

| DIVORCE HIGHLIGHT |

|

PPP loans, goodwill, BIG tax in recent divorce cases

How do you treat a PPP loan in a marital dissolution case? One court addressed this in a case (the first we know of) in Virginia. This will be one of the cases discussed in a session at the upcoming AAML/BVR Divorce Conference in Las Vegas (September 18-20). Also discussed will be several cases on the treatment of the built-in gains (BIG) tax and several of the different nuances of personal versus enterprise goodwill. A family law attorney and two valuation experts will give their perspectives on these important cases in the session, BVLaw Case Update. The presenters will be Drew Soshnick (Faegre Drinker Biddle & Reath LLP), James Ewart (James D. Ewart LLC), and BVLaw editor Jim Alerding (Alerding Consulting LLC). The AAML is the American Academy of Matrimonial Lawyers. Conference attendance is expected to be half experts and half attorneys. To see the full agenda and to register, click here. Up to 20 CPE/CLE credits are available. |

|

Car dealer blue-sky values remain at record levels, per Haig report

“Blue sky” values are 6% higher than at the end of 2021, and they are at the same level as they were at the end of the first quarter of 2022, according to the Q2 2022 Haig Report. Blue-sky value represents the intangible value of a car dealership. A blue-sky multiple is applied to normalized earnings, and then the tangible net assets are added in to get the fair market value of the entire enterprise.

Profitable road: Despite bad news in the economy and weak consumer sentiment, auto dealer profits remained high but growth in profits may be leveling off. M&A activity boomed in the first half of 2022, with 3% more dealerships sold compared to the record-setting pace of the first half of 2021. In these current conditions, a new risk has emerged: Car makers see a chance to restructure the relationship between consumers, retailers, and themselves. To stave this off, dealers will need to stress the value they bring to consumers and the car makers, says the report. To download the full report, click here.

Extra: Join Alan Haig and Nate Klebacha from Haig Partners for a BVR webinar, Auto Dealerships Are Running Hot: Key Valuation Metrics Unique to Auto Dealers, on September 14.

|

|

Two BVers get lifetime award from the ASA

Business valuers George (Mike) Bradford (G. Michael Bradford & Associates) and John Thomson (Klaris, Thomson & Schroeder Inc.) are two of the three recipients of the 2022 Lifetime Achievement Award from the American Society of Appraisers (ASA). The third recipient, Ernest Demba (Demba Valuation Services LLC), is a real estate appraiser. The ASA announced additional 2022 awards that recognize the outstanding efforts of various members, chapters, and staff, and you can see the full list if you click here.

Extra: BVWire will be attending the ASA’s International Appraisers Conference September 10-12 in Tampa, Fla., and BVR will have a booth in the exhibit hall—please stop by!

|

|

Global BV News: Demand for BV experts in Canada is at an all-time high

The awareness of the business valuation profession in Canada has grown, and demand for experts is at an all-time high, says Dr. Christine Sawchuk, the president and CEO of the CBV Institute, Canada’s valuation professional organization (VPO) and standard-setter. In an interview with Ray Moran (iiBV), she discussed some growing trends, including the increased complexity of valuation work, more demand for transparency and disclosure, emerging valuation metrics (such as for data and ESG), and the increased use of automated valuation models. She also discussed the many doors that the CBV designation opens for young professionals and university students. You can watch the full interview if you click here. |

|

BV movers . . .

People: Rob Oliver, who served as president of Lawrenceville, N.J.-based Management Planning Inc. (MPI), has passed away; he joined MPI in 1974 and began serving as its president in 1996, retiring after 30 years with the firm; MPI issued a statement: “Rob was widely considered an early thought leader in the field of business valuations and partnership formation. We are indebted to him for his leadership at the firm and the opportunities he gave so many employees for professional growth in our industry” … Ammar Susnerwala has joined economic damages firm The BERO Group as a financial analyst; he received an undergraduate degree in engineering from the University of Mumbai and a master’s degree in finance from the University of Illinois—Chicago … David Garcia, CPA, CVA, CFE, has been promoted to principal in the forensic, advisory, and valuation services practice at Miami-based Kaufman Rossin; he provides consulting and expert witness testimony on accounting and general commercial litigation matters, as well as financial fraud investigations, embezzlement investigations, and various due diligence matters … Jonathan C. Abbotoy, CPA/ABV, was promoted to manager in business valuation services at Akron, Ohio-based Bober Markey Fedorovich; he provides business valuation, consulting, and litigation support services for purposes related to gift and estate tax planning, mergers and acquisitions, buy-sell agreements, shareholder disputes, breach of contract, economic damages, and family law.

Firms: Stout has acquired Chicago-based Davis & Hosfield Consulting LLC, a litigation-focused financial and economic consulting firm providing damages analyses and expert testimony; the deal adds 17 professionals to Stout … Atlanta-based Mauldin & Jenkins is adding KRT CPAs PC of Savannah, Ga. … Chicago-based Baker Tilly has acquired Management Partners, a government consulting firm that focuses on strategic planning, process improvement, organization analysis, financial analysis, executive recruitment, interim management, coaching, facilitation, and training services … Robert A. Ford, CPA, CVA, MAFF, has combined his Syracuse, N.Y., firm with the DeWitt, N.Y., office of D’Arcangelo & Co.

Please send your professional and firm news to us at editor@bvresources.com. |

|

CPE events

Buy-sell activity is red hot in this industry, and valuations are different than in other industries. Learn the unique characteristics that set dealership valuations apart from others.

This is Part 2 a BVR webinar series that provides a critical and in-depth assessment of the new definitions of fair market value under the regulations for the federal physician self-referral law commonly known as the Stark Law.

|

|

|

Holiday break

BVWire will take a break for the Labor Day holiday next week. We will resume publication on September 14. Have a happy and safe holiday! |

|

We welcome your feedback and comments. Contact Andy Dzamba (Executive Editor) at: info@bvresources.com.

|

|

|

|

Business Valuation Resources, LLC

111 SW Columbia Street, Suite 750, Portland, OR 97201

1-503-479-8200 | info@bvresources.com

© 2022. All rights reserved.

|

|