Pratt reflects and comments on

the future of BV

The business valuation profession is “headed in the right direction” and is in “good hands” with the next generation of professionals, says Shannon Pratt (Shannon Pratt Valuations). Pratt, whose contributions to the profession are legendary, recently participated in a unique interview triggered by the 20th anniversary of Business Valuation Update, a publication he founded. The interview also includes the views of two other generations of valuation experts: Heidi Walker (Meyers, Harrison & Pia Valuation and Litigation Support LLC) and Sean Saari (Skoda Minotti).

Sage advice: “When I started, only a handful of people were doing valuation, and now it’s come to be recognized nationally as a profession,” says Pratt. “Some call it an industry, but I think of it as a profession, and I believe most people think of it that way.” Among his advice to the next generation of valuation experts is to always do a thorough job and not to “cut corners,” despite pressure from clients with a limited budget. Also, always be honest. “A valuer must maintain a reputation for integrity,” he says.

Pratt, who has influenced the lives of countless valuation professionals, was asked if there was someone who influenced him as a young man. He said that his doctoral professor at Indiana University was a big influence, telling him he was a “good conceptualizer, which was important,” says Pratt. “He believed in me.”

Special issue: The full interview is included in the October issue of Business Valuation Update (subscription required), which commemorates the publication’s 20th year as the voice of business valuation. It contains a slew of advice and reflections from a veritable who’s who in the profession. A rundown of the articles is included in this issue of BVWire. It will be a real collector’s item—don’t miss it!

back to top

Court KOs ownership percentage

as rationale for DLOC

Size does not matter, especially when it comes to applying a discount for lack of control. A recent Ohio ruling examines the use of a DLOC where the owner spouse held a small interest in a business, but played a large role in running it.

Man in charge: For about 25 years, the husband worked for two closely held companies that shared common ownership and had an interdependent business relationship. He served as their principal sales person, president, and CEO and also owned a minority interest in both businesses: 1.73% in Company A and 1.37% in Company B.

Given the companies’ interconnectedness, the husband’s expert decided to value them as one entity using the capitalized earnings approach. He said that Company B’s recent loss of a major account and the decline in revenue made him believe the companies might be out of business by 2015 or 2016. By his calculation, the husband’s interest in both companies was worth under $11,400. It was appropriate to apply a 24.3% discount for lack of control and a 15% discount for lack of marketability because of the husband’s minority interest and his limited control over decisions within the company, the expert claimed.

The wife’s expert ultimately used a net asset approach to value both companies. He concluded that the interest in Company A was worth $63,000, including a 10% DLOM, and the interest in Company B was worth $20,000, again including a 10% DLOM. He said a 24.3% discount for lack of control was inappropriate because the husband was a top-ranking executive in both companies. “[W]e are not talking about a 2% investor in California who’s outside the company and doesn’t know what’s going on … we’re talking about an insider who is running the company, who’s in control of that company from a day-to-day standpoint.” The expert also pointed out that the companies had not compelled the husband to sign noncompete agreements.

The trial court agreed with this reasoning, as did the appeals court. According to the trial court, the husband, by his own testimony, was not only a “figurehead but the primary salesperson and key driving force behind the company’s success.” The majority shareholder had to take into account the husband’s influence and control, and it did, as the lack of a noncompete showed.

The husband also raised a double dip claim in connection with the trial court’s order of spousal support, despite the unfavorable view the Ohio Court of Appeals recently has taken on that issue. Here, the appeals court simply found the double dip theory inapplicable given that the prevailing valuation of the business was based on the asset approach.

Takeaway: Control is not simply a function of the size of the ownership interest. Here, the wife’s expert was able to exploit the level of responsibility the husband had in the business to argue against the application of a discount for lack of control.

Find an extended discussion of Sieber v. Sieber, 2015 Ohio App. LEXIS 2256 (June 15, 2015) in the October anniversary issue of Business Valuation Update; the court’s opinion will be available shortly at BVLaw.

back to top

Healthcare M&A market remains hot

It seems that all service providers to the healthcare industry are “in play” as the pace of M&A transactions continues to increase, according to the PCE Industry Report—Healthcare.

The report reveals that transaction volume through the halfway mark of 2015 softened slightly on a rolling 12-month basis (1,348 transactions compared to 1,412 at the same point in 2014). “Despite the decline, this level of activity greatly exceeds the volume of transactions seen historically, as the current rate of M&A is more than twice the annual pace seen as recently as 2011 and 2012,” says the report.

The healthcare services and e-health technology sectors continue to lead the industry with the highest number of transactions. Consolidation of physician practices both large and small continues, and the small practices are also being targeted by local hospital-based systems or one of the nationally focused specialty practice consolidators.

back to top

Global BV news:

Trademark values of OTC drug firms

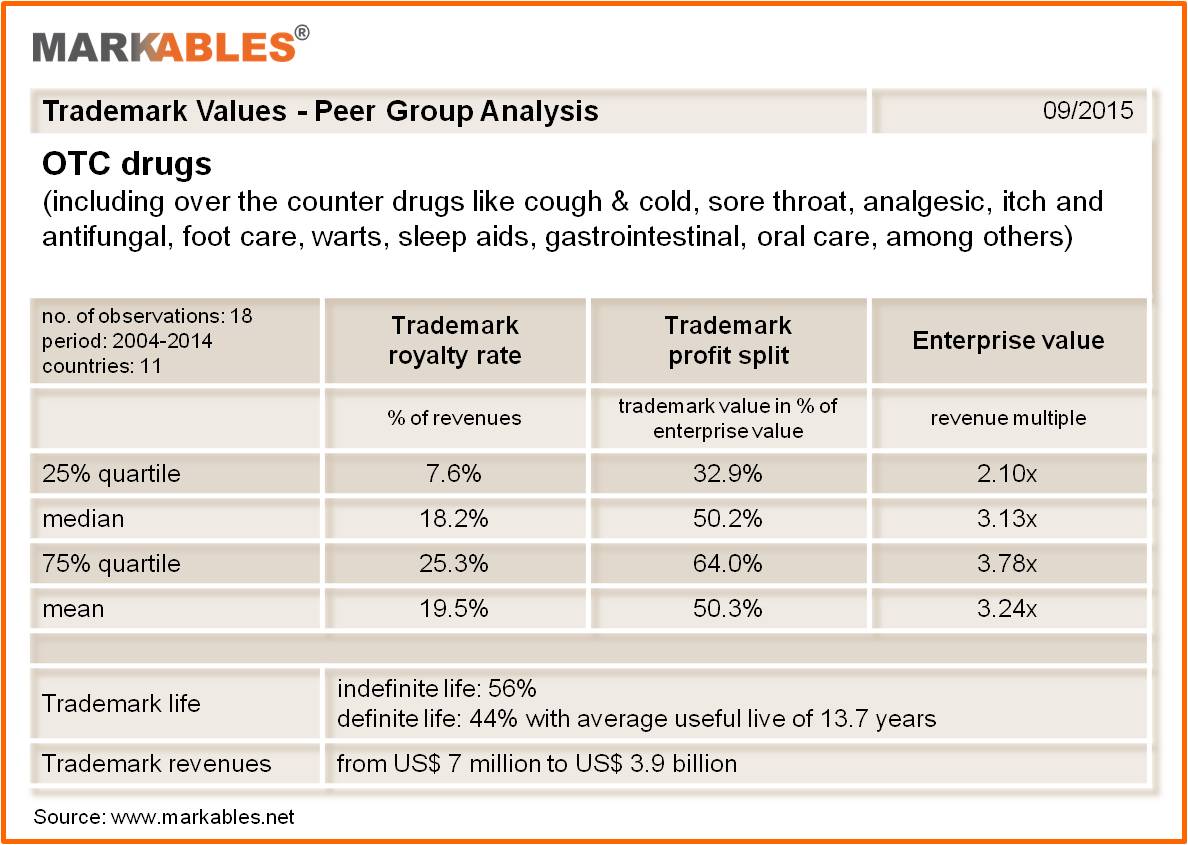

This month’s brand value snapshot from Markables covers a sector with truly high brand values: over-the-counter drugs. The data include brand valuations of 18 OTC drug businesses between 2004 and 2014 in 11 countries. These firms supply non-prescriptive pharmaceutical products, such as for cough and cold, sore throat, pain relief, sleep aids, oral care, itch, antifungal, and others. Some prominent brands in the peer group are Wartner, Listerine, and Nicorette. These are certainly not “love brands” like some brands in sports, fashion, watches, cars, or electronics. But consumers trust and respect them as reliable remedies for minor but annoying health problems.

The interquartile range analysis shows a mean trademark royalty rate on revenues of nearly 20%(!), and a mean trademark value of 50% of enterprise value, for sales multiples of 3x revenues and higher. The OTC drug sector is an impressive example of brand-centric asset structure and high brand margins. It is also conclusive evidence that business appraisers are not overly conservative regarding the valuation of brands, as some people in the profession believe.

Markables has a database of over 6,500 trademark valuations published in financial reporting documents of listed companies from all over the world. The database reports value solely for the use of trademarks (not bundled with other rights).

back to top

Lively Debate 2 set for Paris October 14

Last October, this editor moderated a Lively Debate at the meetings in Toronto of the International Valuation Standards Council (IVSC). The topic of that debate, which was co-sponsored by the International Institute of Business Valuers (IIBV) was “International Business Valuation Education and Accreditation.” The debate there illustrated a growing desire for some designation or indication of a certain competence level for performing cross-border valuations. The second Lively Debate and panel discussion will be held at the upcoming IVSC meetings in Paris on October 14. The title of the event is “Two Truths and a Lie About Global Business Valuation Standards.” The panel will discuss the considerations of new VPOs about appropriate levels of professional standards including education, standards, and quality initiatives. To register for the IVSC meetings, click here. For more information on the Lively Debate 2, go to the IIBV website.

back to top

|

Preview of the October special issue of Business Valuation Update

This issue is a special edition that commemorates the publication’s 20th year as the voice of business valuation. Here’s what you’ll see:

- Three Generations of Valuation Experts Share Their Views (BVR Editor). Shannon Pratt (Shannon Pratt Valuations), Heidi Walker (Meyers, Harrison & Pia Valuation and Litigation Support LLC) and Sean Saari (Skoda Minotti) give their perspectives on the profession and the practice of valuation.

- BVU’s Editorial Board Reflects on the Valuation Profession (BVR Editor). A number of esteemed valuation professionals reflect and give their advice and outlook on aspects of the profession and valuation practices.

- Surviving the Ever-Changing World of Valuation in the Courts (BVR Editor). Valuation experts involved in litigation face a court environment that has changed materially over the years.

- Valuation Concepts Have Undergone Massive Changes in Thinking (BVR Editor). There is much more empirical data now and also a continued questioning of standard practices and conventional wisdom, which is important for the profession to absorb in order to move forward.

- How to Deal With the Ongoing Hiring Crunch Bubble in BV (BVR Editor). There has been a continuing shortage of BV talent in the two-to-five-year experience range. John Borrowman (Borrowman Baker LLC), a recruiter who has worked exclusively in the BV profession for 20 years, gives his insights and advice.

- BVU Through the Years: We combed the archives to create a scrapbook of important articles that chronicle some of the key developments in the valuation profession—with a “fast forward” look at how some of these issues have played out.

- New Features: Ask the Experts and Tip of the Month. Valuation experts answer puzzling questions and give some practical advice on a wide variety of topics.

To read these articles—as well as digests of the latest court cases—see the October issue of Business Valuation Update (subscription required).

back to top

Seven tracks and enhanced training for up-and-comers at the AICPA FVS Conference

BVWire looks forward to attending the AICPA Forensic & Valuation Services Conference 2015 in Las Vegas November 8-10. Last year’s event was fantastic—and this one looks to be even better! Prof. Aswath Damodaran (New York University Stern School of Business) will be one of the keynote speakers.

Seven tracks: Conference-goers will have a choice of sessions in seven tracks: valuation case study, general valuation, general forensics, hands-on forensics, litigation, cutting edge, and industry. For example, the cutting edge track will include valuing PE/VC investments and virtual currencies. The industry track includes valuing marijuana businesses, pro sports franchises, oil and gas, physician practices, and more. Also, there will be three preconference workshops on November 8: Fair Value Workshop, Surviving Cross-Examination, and the NextGen FVS Professional Workshop.

NextGen training: Last year, the AICPA kicked off a new educational program for up-and-comers called the NextGen FVS Professionals Program, tailored to individuals with fewer than five years of BV or forensic accounting experience. The program is designed to help junior members of a firm develop core competencies, such as professional development, steps to building credibility, fostering relationships, case management, communications, and more. The program has been enhanced this year by offering three optional paths: testifying path, forensic path, or valuation path. We hope to see you there!

back to top

BV movers …

People: Jina Etienne, former director of taxation at the AICPA, has been elected by the board of directors of the National Association of Black Accountants (NABA) as new president and CEO, effective September 17… Patricia McGarr, principal at the Chicago office of CohnReznick LLP and national director of valuation advisory services, was honored as one of Real Estate Forum magazine’s 2015 Women of Influence.

Firms: Carr, Riggs & Ingram (CRI) has merged with the Jacksonville-based CPA firm Harbeson, Fletcher & Bateh, establishing CRI solidly as a strong player Florida-wide … Minneapolis-based CliftonLarsonAllen (CLA) has merged with the Dallas-Fort Worth accounting firm Sanford, Baumeister & Frazier. Grassi & Co. has merged in Rispoli and Co., a Long Island, N.Y., firm focusing on trust and estate services; the firm will continue to operate as Grassi & Co. … The San Francisco-based firm Novogradac & Co. was honored for the 13th year to be named by INSIDE Public Accounting (IPA) as Best of the Best Firms … For the 12th year in a row, UHY Advisors’ Southfield, Mich. office was voted one Metropolitan Detroit’s 101 Best and Brightest companies by the Michigan Business & Professional Association.

back to top

4-Hour Monte Carlo Workshop highlights CPE events

A special 4-hour workshop, Advanced Workshop on Monte Carlo: From Classroom to Boardroom to Courtroom, will be held on September 29. The workshop, featuring presenters Michael Pellegrino (Pellegrino & Associates LLC) and Dave MacAdam (Novelis), will cover the use and application of Monte Carlo simulation in business valuation while delivering real-world examples and best practices for using and defending Monte Carlo simulation in litigation. “Monte Carlo is not going away. Since 2005, I’ve used Monte Carlo in over 300 engagements, including work that was critically inspected by the IRS, SEC, and opposing counsel. This advanced Web workshop will help you build and defend Monte Carlo simulations in your valuations,” says Pellegrino.

Also on the CPE schedule as we usher in the fall season:

Working Capital and Value: Gone But Not Forgotten? (October 6), with Glen Birnbaum (Heinold Banwart, Ltd.) and Kevin Yeanoplos (Brueggeman and Johnson Yeanoplos, PC).

Why You Need to Use Local Market Rates for FMV in Physician Compensation and How to Calculate Them (October 8), with Mark O. Dietrich (Mark O. Dietrich, CPA, PC) and Timothy Smith (Ankura Consulting Group LLC). This is Part 5 of BVR's 2015 Special Series on Healthcare Valuation.

Important note to webinar attendees: To ensure that you receive your dial-in instructions to BVR’s training events, please make sure to whitelist bvreducation@bvresources.com.

back to top

|

We welcome your feedback and comments. Contact the editor, Andy Dzamba at:

info@bvresources.com or (503) 291-7963 ext. 133 |