New survey on use of Monte Carlo in business valuation

The use of Monte Carlo to analyze how uncertainties influence value conclusions has been a big topic at all of the major business valuation conferences this season. So we decided to survey business appraisers to see how many are using this technique and, if so, in what circumstances.

More than half use it. We received a relatively small number of responses (110), suggesting that the method is still on the fringes for the BV community. The majority of our respondents (58%) have used Monte Carlo analysis in a valuation report but do so “as required by circumstances.” A growing 15% use it in nearly every valuation, and the remainder (32%) use it “infrequently.”

The most common applications of this method are for fair value financial reporting and the valuation of complex securities. Valuations of early-stage entities is another common application. Interestingly, over a quarter of those who use the method now use it in valuations having to do with business disputes.

Our thanks to those of you who responded to the survey, and we will send you a copy of the full results. Stay tuned for our next survey!

back to top

Ohio divorce court includes AR in asset-based valuation

Is a business that bills its customers worth more than one that’s cash and carry? Yes, says an Ohio divorce court—and the appellate court agrees. This is another case in the ongoing saga of the double dip. The issue in this case is whether to include accounts receivable in the value of a business when using the asset approach.

Painful extraction: The parties fought over the valuation of the husband’s dental business. The wife’s expert used the company’s balance sheets and made several adjustments to reach a valuation of nearly $313,300. One of the adjustments was adding over $200,000 in accounts receivable to the business value. To determine income for spousal support purposes, he averaged earnings from the business for three years as a starting point and reduced that figure by the child and spousal support paid. He calculated a pretax monthly spousal support amount of nearly $6,300.

On cross-examination, he was asked about the accounts receivable. He explained that, in terms of taxes, “When those receivables are collected in the subsequent period or in the following year, they would be recognized as taxable income as the collection of those receivables in that subsequent year.” He added, “There’s going to be approximately 200-some thousand dollars of accounts receivable in existence, and those are going to, as a rolling advantage, continue being collected and recognized as cash-basis income.” When asked about the 2008 Heller case ruling on double dipping, he said double-dipping “has no bearing on an instance where the company is valued based on an asset approach.” This was the case here.

The trial court adopted his business valuation as the “most conservative and directly relevant—and therefore the most equitable”—determination. Based on the three-year average earnings the wife’s expert calculated, the court also ordered monthly spousal support payments of nearly $6,300 for an indefinite period.

Present stream of income: On appeal, the husband claimed that the wife’s expert dipped into the very accounts receivable he used to value the business when he calculated earnings for spousal support. The accounts receivable were akin to “future business profits” or a “future stream of income,” as contemplated in Heller and Gallo. Therefore, an asset-based valuation does not preclude the occurrence of a double dip, the husband contended. He cited a Wisconsin case that prohibited any account receivable from being classified as a martial asset and as income includable in the spousal support calculation as support.

The appeals court dismissed the significance of the Wisconsin case. Moreover, the accounts receivable were present assets of the company “in the sense discussed by Heller I or Gallo,” the Court of Appeals emphasized. Although Ohio law did not provide a ready definition of “future income streams,” case law suggested the phrase meant the “projected, ongoing value of an asset.” Courts have mentioned “pensions, business and professional goodwill, and dividend-yielding stock” as the types of assets that generate future income streams, the appeals court observed. Further, in the recent Sieber case, the trial court treated the accounts receivable that was included in the prevailing asset-based valuation as present, not future, income, the Court of Appeals added. The trial court’s valuation and spousal support findings were not error, the appeals court concluded.

Takeaway: Ohio divorce law does not consider accounts receivable as a future income stream for purposes of the double dipping analysis.

Find a discussion of Settele v. Settele, 2015 Ohio App. LEXIS 3629 (Sept. 15, 2015), in the December issue of Business Valuation Update; the court’s opinion will appear soon at BVLaw. Digests and court opinions of the other cases mentioned above also are available at BVLaw (subscription required).

back to top

Say goodbye to Step 2 of the goodwill impairment test

The “dreaded” Step 2 of the goodwill impairment test for public companies is on its way out, according to a report in Compliance Week. The Financial Accounting Standards Board has tentatively decided to drop Step 2 to make things simpler for public firms. According to the report, the FASB decided to revisit the issue when it approved rules for private companies that no longer require annual testing for goodwill impairment. Private companies can amortize goodwill over 10 years but must do an impairment test under certain conditions.

back to top

Trademark values in wireless telecom industry

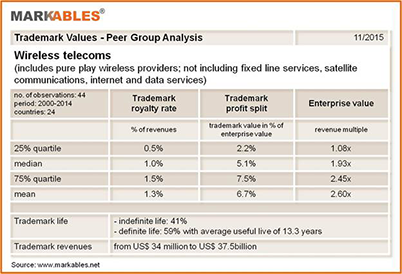

This month’s brand value snapshot from Markables covers the wireless telecom sector. A comparison reveals brand valuations of 44 wireless telecom businesses between 2000 and 2014 in 24 countries. Some prominent brands in the peer group are Nextel, Leap, Cingular, Vivo Móvel, E-Plus, debitel, O2, Metro, Orange, Mobinil, and more.

Low brand multiples: Although perceived as an industry with high advertising spending, brand value multiples for the sector are rather low. The major reason is that assets other than brand are typically much more valuable (i.e., spectrum licenses, customer relations, and the network itself).

The interquartile range analysis shows a mean trademark royalty rate on revenues of 1%, and a mean trademark value of 5% of enterprise value, for sales multiples of 2x revenues. The multiples are consistent with the variation of factors such as territory (emerging versus developed), revenue size, or period (pre- or post-financial crisis). Not surprisingly, the multiples increase slightly with profitability. The reported brand values are in contrast to some publications that advocate higher brand values in the telecom sector, including the Brand Finance Telecoms 500 ranking.

Markables has a database of over 6,500 trademark valuations published in financial reporting documents of listed companies from all over the world. The database reports value solely for the use of trademarks (not bundled with other rights).

back to top

Latest multiples for the healthcare services sector

The S&P Healthcare Services Index has declined 3.9% over the last three months, but it has continued to outperform the S&P 500, which declined 6.9% over the same period, according to the October 2015 Healthcare Sector Update from Duff & Phelps. The best-performing sectors were other services (up 14.6%), home care/hospice (up 1.1%), and physician practice management (up 0.8%). The worst-performing sectors were assisted living (down 26.0%), diagnostic imaging (down 24.0%), and clinical laboratories (down 22.0%).

The current median LTM revenue and LTM EBITDA multiples for the healthcare services industry overall are 1.53x and 12.5x, respectively. The sectors with the highest valuation multiples include: other services (2.78x LTM revenue, 28.5x LTM EBITDA), healthcare REITs (11.84x LTM revenue, 17.0x LTM EBITDA), and emergency services (3.19x LTM revenue, 23.4x LTM EBITDA).

back to top

Article examines New York state’s obsolete position on DLOM

New York's position with respect to the discount for lack of marketability is unique compared to the other states. “It stands alone in that it favors (and some lower courts believe requires) the imposition of a marketability discount on dissenting shareholders in fair value determinations,” writes Gil Matthews (Sutter Securities) in an article that examines New York’s DLOM situation in the upcoming December issue of Business Valuation Update. “There is broad consensus that DLOMs should seldom, if ever, be permitted in appraisal or oppression cases.” Matthews points out that New York is out of line with both the Model Business Corporation Act (MBCA) and the American Law Institute (ALI) “as well as the widely accepted view in other states and in legal literature.”

The recent Ferolito decision (2014), which valued the AriZona Beverage business, would have been a great chance to re-examine the issue on appeal (the Court of Appeals is the highest court in New York). However, there was a post-trial settlement, so that won’t happen. Matthews concludes: “A re-examination of New York’s obsolete position on DLOMs is long overdue.”

back to top

Global BV news:

Comments wanted on international PE/VC fund valuation guidelines

The International Private Equity and Venture Capital Valuation Guidelines Board (IPEV Board) has published draft amendments to its guidelines and seeks input and comments. The draft update is available here.

Last update in 2012: The IPEV Valuation Guidelines are reviewed periodically to ensure they continue to promote best practice when valuing investments and to incorporate changes to accounting standards. The guidelines were last updated in 2012, and this year’s update reflects the experience of industry practitioners applying IFRS 13 (international accounting standards) for three years, as well as continued experience of ASC Topic 820 (US GAAP).

The IPEV Board was created as an independent body in 2005 and is responsible for maintaining, promoting, monitoring, and updating the IPEV guidelines. The board has an advisory role and gives guidance on the application of the guidelines to all stakeholders in the private equity and venture capital industry, including practitioners, investors, regulators, and auditors.

Due November 27: Please send your comments and suggestions related to the draft update to contact@privateequityvaluation.com addressed to David Larsen, IPEV Board vice chair, by Nov. 27, 2015.

back to top

|

BV movers . . .

People: Wayne Berson was re-elected to a second term as CEO of BDO USA; during his initial four-year term, Berson has led the firm to 70% growth in revenue and merged in 13 firms in 20 new cities … Simon Jewkes and Drew Soga joined FTI Consulting Inc.’s corporate finance/restructuring group as managing directors. Jewkes will be based in New York City, and Soga in Chicago … Matthew Stelzman, manager at the Chattanooga firm Henderson Hutcherson & McCullough, was selected by the National Academy of Public Accounting Professionals (NAAP) as one of 2015’s "Top 10 Public Accounting Professional Rising Stars" in Tennessee … Harvey Wallace, co-founder of the St. Louis-based firm Brown Smith Wallace, will step down as managing partner at the end of the year; Anthony Caleca, the firm’s current partner-in-charge of audit, will assume the role of managing partner on Jan. 1, 2016.

Firms: For the fourth year in a row, Averett Warmus Durkee was honored as one of the “Top 100 Companies for Working Families in Central Florida” by the Orlando Sentinel … Citrin Cooperman acquired Joel Popkin & Co., a 45-year-old New York City-based accounting firm that specializes in restaurants and event businesses … Keiter CPAs, the third largest accounting firm in central Virginia, was honored with the 2015 Edge Award for “Best Marketing Initiative” in a niche area by Leading Edge Alliance Global, the second-largest international association of accounting firms in the world.

back to top

Risk, DLOM, EEM highlight November CPE events

Advanced Risk Issues in Business Valuations (November 17), with Mark Gottlieb (MSG Accountants).

How to Prepare a Discount for Lack of Marketability for the IRS (November 18), with Michael Gregory (Michael Gregory Consulting LLC). This is Part 2 of BVR's 2015 Special Series on Discounts for Lack of Marketability.

Treasonable Compensation? The Continued Misapplication of the Excess Earnings Method (November 19), with Kevin Yeanoplos (Brueggeman and Johnson Yeanoplos PC) and Ronald Seigneur (Seigneur Gustafson LLP CPAs).

Important note to webinar attendees: To ensure that you receive your dial-in instructions to BVR’s training events, please make sure to whitelist bvreducation@bvresources.com.

back to top

|

We welcome your feedback and comments. Contact the editor, Andy Dzamba at:

info@bvresources.com or (503) 291-7963 ext. 133 |