Latest New York statutory fair value ruling nixes DLOM

A New York trial court recently issued a decision in connection with the buyout of a minority shareholder that provides rich fare for valuation professionals. The court’s somewhat unusual (for New York) take on the use of a marketability discount is only one of the issues making the ruling a treat.

Sneak preview: The case involved three (roughly equal) partners who owned Planet Fitness franchises in two corporate entities. The minority owner sued the others, asking for a judicial dissolution, but they ultimately agreed to a fair value determination by the court. The plaintiff’s expert was a tax lawyer with no valuation experience. In contrast, the defendants’ expert was “a true valuation professional,” as the court called him. The plaintiff’s expert valued the two corporations at over $162 million and the seller’s interest at over $53 million. The defendants’ expert valued one of the entities at $6.2 million and the other at $208,000. He concluded the plaintiff’s one-third interest was worth approximately $2.2 million.

The court allowed the plaintiff’s expert to testify on valuation but completely discredited his work product. At the same time, it had some harsh words for the defense expert’s valuation as well. Ultimately, the court decided to use the defendant expert’s basic approach and modify it to raise the value of the plaintiff’s interest to $8.8 million.

No justification for DLOM: One of the court’s major adjustments was nixing the 35% marketability discount the defendants’ expert had applied. His report showed that only a portion of the discount rate related to marketability, and much of it related to a potential tax liability the expert saw, the court noted. However, he was unable to adequately explain when the unfavorable tax treatment would set in, the court said. It also dismissed the expert’s rationale that there would be a prolonged holding period. His effort “to maximize Defendants’ position by a ‘high-end’ discount is thus not persuasive,” the court said. Citing the Zelouf case, the court noted that no New York appellate court ever held that a marketability discount was mandatory—especially not in a situation where the defendants made it clear that they were not planning to sell.

Other issues: The court picked at other aspects of the defense valuation, including the defense expert’s decision to normalize historic income by nearly doubling officer compensation; his “roller-coaster” revenue growth model; and his decision to tax affect one company’s earnings by 18.5% to account for its being a pass-through entity. The latter suggested he “was unduly focusing on the buyer’s side of the equation,” the court noted.

Takeaway: In the latest New York statutory fair value ruling, the court noted that while it would have considered an entity-level discount for lack of marketability based on certain transfer restrictions operating on franchisees, the expert’s failure “to provide a basis for calculating the appropriate amount of the discount,” as well as other factors, militated against the use of a DLOM.

The case is La Verghetta v. Lawlor, Index No. 5934/2014, N.Y. Sup. Ct. [County of Westchester](March 9, 2016). An extended discussion of the case and the court’s opinion will appear in the May issue of Business Valuation Update and at BVLaw. A digest and the court’s opinion for Zelouf Int’l. Corp. v. Zelouf, 2014 N.Y. Misc. LEXIS 4341 (2014) are available at BVLaw.

back to top

Do you need empirical support for passive appreciation?

In a recent webinar, Prof. Ashok Abbott (West Virginia University), a consultant to top valuation firms who testifies in cases involving active and passive appreciation, discussed his empirical methodology for isolating the passive component of a firm’s appreciation in value. He presented his analysis of causal factors and their elasticities for several industries. For example, for the period 1992-2014, 88% of the change in grocery sales was due to factors over which the industry had no control.

A webinar attendee asked: Are there any published sources of causal factors and elasticities by industry? Dr. Abbott replied “no,” but he offered to provide some of this analysis in future issues of Business Valuation Update.

Vote now: Take a quick survey to tell us which industries you’d like to see analyzed for causal factors and their elasticities, and Dr. Abbott will address them in the order of preference. Thanks in advance for helping us help you!

back to top

Judge calls DCF for energy plant a ‘financial haruspication’

The valuation of a waste-to-energy plant in Bridgeport, Conn., is the subject of an ongoing property tax dispute between the plant’s owner and the city. The company accuses the city of inflating the property’s valuation in order to fill gaps in the city's budget, according to a report in the ConnecticutLawTribune. The company, Wheelabrator, values the plant at $200 million while the city says the value is $400 million.

Say what? In state superior court, the judge reduced the amount to $314 million and rejected the DFC approach the company used, calling it "financial haruspication,” or akin to the archaic technique of using the entrails of sacrificed animals to predict the future. The judge said the proper valuation method is the reproduction cost approach. On appeal, the state’s Supreme Court said that the trial judge erred by dismissing the DCF approach without offering a legal rationale for doing so, even though some experts said it was the appropriate way to evaluate this type of facility. A new trial was ordered on the valuation issue.

Cash-starved municipalities sometimes veer away from traditional real estate valuation methods in favor of business valuation methods that can produce a value that encompasses intangible assets—which are not subject to property taxes in some jurisdictions. Of course, the practice of inflating valuations may be inadvertent. Regardless, it presents an emerging valuation practice opportunity, as many commercial property owners may be paying too much tax.

What to do: First, examine the local areas to see whether the laws exempt certain intangible assets from commercial property taxes. Then, determine whether the assessment for the client’s property includes the value of exempt intangible assets. If it does, these exempt assets must be identified and valued in order to subtract them from the assessment.

back to top

Feedback wanted on new paper concerning midyear discounting

Mike Crain (Financial Valuation Group) has written a white paper for his graduate students at Florida Atlantic University on the midyear discounting convention and Gordon growth model. The paper is somewhat technical, and he has requested comments from the BV community. You can access the white paper if you click here.

back to top

Global BV news:

Global trademark values for hospitals

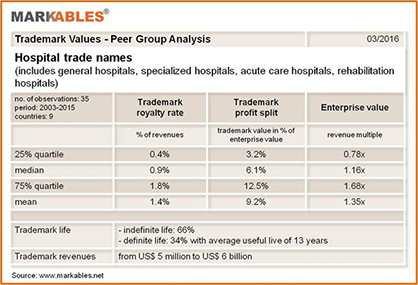

Reputation is very important for providers of medical services. Yet the value of trade names and brands in the healthcare sector has received little public attention. A peer group analysis from Markables illustrates trademark comparable data for 35 hospitals from nine countries. In this sector, trademark royalty rates range from 0.4% to 1.8% on revenues, with a median rate of 0.9% (see chart). Based on these royalty rates, trademarks account for approximately 6% of enterprise value. Average enterprise value multiples for the sector are 1.2x revenues.

Three drivers: Hospitals have many different business approaches and positioning, according to the analysis. Apparently, the value of a hospital’s name and brand has three major determinants. First, health benefit plans must give patients the freedom to make their own choices of healthcare providers. Second, the type of treatment must allow freedom of choice. Acute care often requires treatment nearby, so there are fewer options than for planned treatment. And third, there must be choices among different hospitals offering the same services in an acceptable proximity. The more regulated the sector, the lower the value of the hospital’s trade name. Fully private clinics in countries like Switzerland, Singapore, or UAE often attract international patients and can easily achieve brand name royalty rates of 5% on revenues.

Markables, based in Switzerland, now has a database of over 8,200 trademark valuations published in financial reporting documents of listed companies from all over the world. The database reports value solely for the use of trademarks (not bundled with other rights).

(Click on image to view full size)

back to top

|

Test your BV IQ on fair value

BVR kicks off a new webinar series on fair value starting with back-to-back events: First is Business Combinations: Case Studies in Purchase Price Allocations on March 23, presented by Nathan DiNatale (SC&H Group). The next day, March 24, will feature Business Combinations: Valuation of Intangibles, also presented by DiNatale, who will be joined by Mark Zyla (Acuitas, Inc.).

Quiz yourself: Are you current on fair value issues? Find out by taking this short quiz now.

back to top

Coming in the April issue of Business Valuation Update

In the April issue of Business Valuation Update, the section formerly called Legal & Court Case Updates has been renamed BV Case Update and Analysis to better describe the content in that section. Also, our new monthly BV News At-a-Glance gives a fingertip summary of timely developments in the profession. In addition, here’s what you’ll see:

- Fannon and Dunitz Bridge the Gap in the Practice of Economic Damages (BVR Editor). An interview with Nancy J. Fannon (Meyers, Harrison & Pia) and Jonathan M. Dunitz, Esq. (Verrill Dana), who have just completed the fourth edition of the book, The Comprehensive Guide to Economic Damages.

- Multifactor Scorecard Analysis Helps With Debt-Versus-Equity Problem (J. Richard Claywell). The author presents a scorecard analysis based on the Mixon case and others that analysts can use to help make a determination of whether money transferred to a company represents debt or equity.

- Experts Field Queries on Hot Topics Affecting Midstream Oil & Gas Firms (BVR Editor). Dan Visich and Tom Ramos, oil and gas valuation experts who are both with BDO Consulting, recently answered questions on how some current issues are affecting oil and gas firms in the midstream sector.

- New Approach to FMV of Physician Pay Could End Hospital Woes (BVR Editor). Unless there’s a change of outlook over the fair market value of physician compensation, hospitals will stay on the government’s radar for fraud and abuse claims. Speakers at the recent AICPA Healthcare Industry Conference in Las Vegas challenge conventional wisdom and offer a different approach.

- Regular Features: BV News At-a-Glance, Ask the Experts, Tip of the Month, Pratt’s Stats MVIC/EBITDA Trends, Economic Outlook for the Month, and Cost of Capital Center.

- BV Case Update and Analysis: The latest court cases that involve business valuation issues.

To read these articles and the case digests, see the upcoming April issue of Business Valuation Update.

back to top

BV movers . . .

People: Steve Campana was promoted to partner, and Robert Leibfried was promoted to business valuation manager at Honkamp Krueger & Co. based in Dubuque, Iowa … David Goodman, director of litigation and business valuation at Gosule, Butlkus & Jesson out of Milton, Mass., has been elected to the board of the Massachusetts Collaborative Law Council.

Firms: The Alabama-based Carr, Riggs & Ingram expanded into southeast Texas by merging with the Conroe firm McGee, Miller & Co., which services health care providers, construction companies, manufacturing and distribution companies, and consumer products organizations … The Mt. Arlington-based Nisivoccia was named one of the “Best Places to Work” in New Jersey in the small/medium category for the fourth year in a row by NJBIZ.

back to top

March keeps roaring with CPE events

Forecasts and Projections for Small Companies (March 17), with George Levie (George Levie CPA).

Business Combinations: Case Studies in Purchase Price Allocations (March 23), with Nathan DiNatale (SC&H Group). This is Part 1 of BVR's Special Series on Fair Value.

Business Combinations: Valuation of Intangibles (March 24), with Nathan DiNatale (SC&H Group) and Mark Zyla (Acuitas, Inc.). This is Part 2 of BVR's Special Series on Fair Value.

Important note to webinar attendees: To ensure that you receive your dial-in instructions to BVR’s training events, please make sure to whitelist bvreducation@bvresources.com.

back to top

|

We welcome your feedback and comments. Contact Andy Dzamba (Executive Editor) or Sylvia Golden (Executive Legal Editor) at:

info@bvresources.com. |