New credentials coming up for fair value measurements

The AICPA, along with other valuation professional organizations, the ASA and Royal Institution of Chartered Surveyors (RICS), plus The Appraisal Foundation, are banding together to provide common education, credentialing, and governance in valuations for financial reporting, according to Mark Zyla (Acuitas), a leading expert in this area and the author of the book Fair Value Measurement: Practical Guidance and Implementation, available from BVR.

First step: The AICPA has authorized the development of two new specialty credentials in the area of fair value measurement, according to an announcement. The credentials are expected to launch in 2016 and will cover the areas of fair value measurement for: (1) business and intangible assets; and (2) financial instruments. They will be available to CPAs and other qualified professionals who meet eligibility requirements determined by the AICPA. “The approval of the two fair value measurement credentials by the governing council of the AICPA is a significant first step in enhancing the valuation profession in the area of fair value,” Zyla tells BVWire. “The other VPOs are likely to follow soon with approvals to develop very similar credentials.”

According to the AICPA, all fair value measurement credential holders will be required to demonstrate competency, adhere to mandatory performance framework, and comply with ongoing fair value measurement engagement quality review. In addition, fair value measurement credential holders will be required to meet CPE requirements and adhere to the AICPA code of conduct.

“The development of a fair value credential, even while in the early stages, allows the profession to further increase its stature in the public trust,” says Zyla.

back to top

Judge likes show-and-tell from valuation experts

“I like PowerPoints that help me follow along with what the valuation expert is saying,” says Judge Alan D. Scheinkman, who is a justice of the Supreme Court in New York in the 9th Judicial District. Judge Scheinkman spoke at the recent annual business valuation conference in New York City hosted by the New York State Society of CPAs (NYSSCPA). Also, valuators should not memorize their report and present too much material in court, he advises. “I prefer that the valuation expert hit the highlights, and the presentation should be no more than one hour,” says the judge.

back to top

Unusual FRE 702 ruling puts expert in ‘uncommon position’

May a court exclude an expert’s opinion (conclusions) but still admit his or her “non-opinion” testimony under Federal Rule of Evidence 702? This evidentiary issue recently came up in a case that, although not a valuation dispute, is instructive for any expert practicing in federal court.

When the plaintiff failed to repay the loan he had received from the defendant, a court said the defendant was entitled to a number of shares of the plaintiff’s company, which served as collateral for the loan. The stock traded on the over-the-counter QB Tier Market (OTCQB). The defendant subsequently sold the shares, prompting the plaintiff to allege wrongful disposal of the collateral. OTCQB was not a “recognized” market under state law and the sale was not commercially reasonable, the plaintiff claimed.

The defendant offered expert testimony on OTC securities trading. The testimony was in the form of an affidavit that included four opinions and eight factual statements. One of the expert’s conclusions was that OTCQB qualified as a “recognized market.”

Helpful to court: The plaintiff filed a pretrial motion to exclude the testimony under Rule 702. The magistrate judge found the witness qualified as an expert but said he could not testify about the four opinions because they were impermissible legal conclusions. At the same time, the judge ruled the expert had other “knowledge, skill, experience, training or education” that helped the judge understand the evidence and decide the legal issues. She determined that she could consider the expert’s factual statements as to “the operation, function, and trading of stocks on over-the-counter securities markets generally, as well as the OTCQB in particular and how it functions, operates, and how stocks trade on the OTCQB.” Ultimately, the judge recommended an outcome of the case that favored the defendant.

The plaintiff attacked the 702 ruling in federal court, arguing it was error to permit the expert “to testify about any ‘facts’ that support his properly excluded opinions.”

The federal court allowed that the magistrate judge’s decision “left [the witness] in a relatively uncommon position for an expert.”

But “the available authority on the issue” strongly suggested the magistrate judge’s ruling was correct, the court said. For one, Rule 702(a) provides that a witness who qualifies as an expert “may testify in the form of an opinion or otherwise if: (a) the expert’s … other specialized knowledge will help the trier of fact.” Further, the advisory committee notes to the rule state: “Most of the literature assumes that experts testify only in the form of opinions. The assumption is logically unfounded.” Here, the judge’s exclusion ruling did not nullify the expert’s qualifications to provide helpful background information on over-the-counter markets, including OTCQB.

Takeaway: There’s more to expert testimony than an expert’s opinion.

Find a discussion of Ross v. Rothstein, 2015 U.S. Dist. LEXIS 30180 (March 12, 2015), in the June edition of Business Valuation Update; the court’s opinion is available at BVLaw.

back to top

DLOC and DLOM for real estate entities

Discounts for a noncontrolling and nonmarketable interest in a real estate entity are the focus of a recent article by Russell T. Glazer (Gettry Marcus CPA, PC) in the New York Law Journal. The article examines the differences in the analysis by a real estate appraiser versus a business valuation expert.

The article points out an important distinction: Ownership of a real estate entity does not represent ownership of the underlying assets. The real estate appraiser is typically asked to value a 100% interest in the real estate without any limitations on control or marketability. In some cases, the interest includes certain rights of property use, possession, disposition, and so on. But a noncontrolling ownership interest in an entity that owns real estate has no such rights. For these interests, discounts for lack of control (DLOC) can be 20% or more, and the discount for lack of marketability (DLOM) can be 35% or more, according to the article. Therefore, the value of the noncontrolling interest in the entity may be about 50% of the entity’s net asset value.

Special report: There are unique challenges to valuing a business that owns its real estate, so BVR has prepared a special report, Valuing Companies with Real Estate: Appraisal Experts Untangle the Issues. It explores the interaction between real property value and business value for going-concern properties.

back to top

Value of famous eateries may be part of celeb divorce battle

The value of a food celebrity’s restaurants may figure into his divorce case—if his estranged wife has her way.

Food fight: The wife of Bobby Flay has filed legal documents to set aside their prenup to give her more of a bite out of her husband’s success. She claims the agreement should not be enforced because she’s the reason he became wildly successful, according to a report from TMZ. The wife is also making allegations of adultery, which could bolster her case. Under the terms of their prenup, Flay, who’s worth an estimated $20 million, only has to pay wife Stephanie March $5,000 a month. Flay has a number of cooking shows on Food Network, has written several cookbooks, and owns a bunch of restaurants, including Bar Americain, Bobby Flay Steak, Bobby’s Burger Palace, Gato, and Mesa Grill.

BVR recently served up a webinar, Valuing Restaurants: A Case Study, presented by expert Lynton Kotzin (Kotzin Valuation Partners LLC). Kotzin went through a detailed numbers example of the valuation of a company that owned a group of Subway sandwich shops.

back to top

Healthcare services sector trading performance and multiples

The S&P Healthcare Services Index has increased by 9.3% over the last three months, outperforming the S&P 500 (a 4.5% increase over the same period), according to the May 2015 Healthcare Sector Update from Duff & Phelps. The best performing sectors were emergency services (up 55.9%) and psychiatric hospitals (up 18.6%). The worst performing sectors were specialty managed care (down 12.7%) and healthcare REITs (down 10.8%)

Latest multiples: The current median LTM revenue and LTM EBITDA multiples for the healthcare services industry overall are 1.74x and 12.9x, respectively. The sectors with the highest valuation multiples include: HCIT (3.54x LTM revenue, 22.3x LTM EBITDA), emergency services (2.80x LTM revenue, 27.9x LTM EBITDA), and consumer-directed health and wellness (3.18x LTM revenue, 20.0x LTM EBITDA).

back to top

GLOBAL BV NEWS

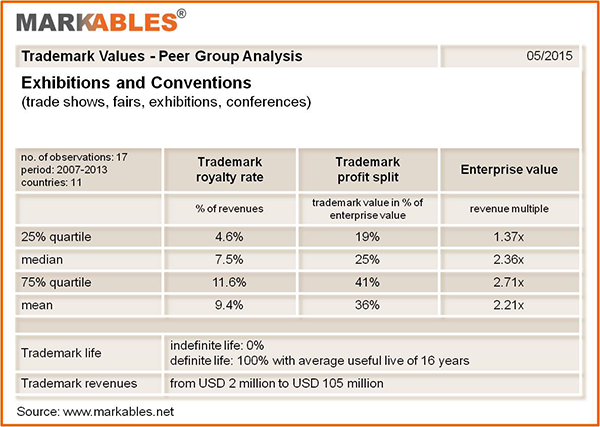

Trademark valuation data for exhibitions and conventions

The median trademark royalty rate for exhibition and convention brands is 7.5% of revenue and a 25% share of enterprise value, according to a new analysis from Markables. The analysis covers 17 brands of exhibitions and conventions from 11 countries. The sample includes national and international trade shows and conferences for various types of professional audiences, such as one of the largest fashion trade shows in Asia. Not surprisingly, brand is an important value driver for such businesses, as well as customer databases. Other assets are of minor importance. Prices paid for such businesses are quite high, with a median multiple of 2.4x revenues. It is worth noting that remaining useful life is finite for all 17 brands, with an average of 16 years.

This information is gleaned from the Markables database of over 5,000 trademark valuations published in financial reporting documents of listed companies from all over the world. The database reports value solely for the use of trademarks (not bundled with other rights).

back to top

RICS issues IP valuation guidance in Hong Kong

The Royal Institution of Chartered Surveyors (RICS) has announced the release of the RICS intellectual property (IP) valuation guidance note. Developed to clarify the legal, functional, and economic characteristics of IP, the guidance note can help establish industrywide professional standards and ensure that RICS members provide the highest quality and consistency of valuation services. The guidance note also contributes to the development of Hong Kong as an international IP trading hub. For more information, click here.

IP event: In Hong Kong, RICS will host an event, Seminar on IP-Valuation, Financing and Transactions, on, July 8. Speakers will be: Nova Chan (PwC China), Stella Law (Crowe Horwath), and Anita Leung (Jones Day). For more information, click here.

back to top

Stay current on M&A news and trends in Europe and Asia

Two new additions to BVR’s Global Resource Centre, the Mergerstat Europe Quarterly Review and the Mergerstat Asia Quarterly Review, are now available. Both PDF publications provide a look inside active M&A companies and industries by activity and value in each region. These publications are essential for those involved in European and Asian mergers and acquisitions.

Sections in each publication include:

For a sample of the Mergerstat Europe Quarterly Review, click here. A sample of the Mergerstat Asia Quarterly Review can be found here.

back to top

|

BV movers . . .

People: Two new associates join Amherst Partners’ Birmingham, Mich., office: Maxim Ananich in the restructuring and investment banking group and Ryan McLean in the dispute advisory and forensic services group … Kevin Baril joins Grant Thornton LLP as principal in the advisory practice and will work out of the firm’s San Diego office … Kevin Kiyan, Ph.D., was named managing director of Andersen Tax’s U.S. national tax office and will be based out of the Los Angeles office. His focus will be transfer pricing and the improvement of pricing data reporting processes and systems … Frank Longobardi, currently a member of CohnReznick LLP’s executive board and management committee, is the new CEO-elect, effective October 1, when current co-CEOs Ken Baggett and Tom Marino step down. He will be based out of the Hartford, Conn., office.

Firms: DiSanto, Priest & Co. of Warwick, R.I., was awarded the AICPA’s 2014 Public Service Award for Firms,honoring the firm’s demonstrated outstanding public service … The Tulsa, Okla., firm Sartain Fischbein & Co. agreed to merge into North Dakota-based Eide Bailly LLP on June 1. With this merger, the firm now has a total of 26 offices in 12 states with 1,600 employees including 236 partners … The national firm Valuation Research Corp. (VRC) was named the Valuation Firm of the Year at the International M&A Awards for the fourth consecutive year.

back to top

Spring winds down with some great CPE events

BVR has some exciting CPE events that take you through the end of spring:

Important note to webinar attendees: To ensure that you receive your dial-in instructions to BVR’s training events, please make sure to whitelist bvreducation@bvresources.com.

back to top

|

We welcome your feedback and comments. Contact the editor, Andy Dzamba at:

info@bvresources.com or (503) 291-7963 ext. 133 |