|

|

BVWire is your go-to source for the latest in the business valuation profession. Highlights for this week include:

|

YE2018 data—plus enhancements—now in the Cost of Capital Professional

Year-end 2018 equity risk premia and size premia are now available in BVR’s Cost of Capital Professional platform. In addition, several new enhancements have been made to the platform. They include:

- Beta-adjusted size premia (a new paper says that using beta-adjusted size premia may be important to prevent overstating risk);

- Excel download of user-selected variables and calculations, including citations of all sources used;

- Ability to compute the weighted average cost of capital (WACC); and

- Ability to choose geometric mean returns or arithmetic mean returns.

In terms of the ERP, you can enter your own values if you wish, and there is an accompanying field to enter notes that support your selection. As for the size premium, you may be asking: How is firm size measured? The Cost of Capital Professional platform presents return data across firm sizes with size measured as market value of equity (market capitalization). This measure is very likely the most common measure of firm size in academic research on the cross-section of equity returns. Using the market value of equity for firm size is market-oriented and captures forward-looking expectations of market participants. |

|

Starkly different valuation narratives in Vinoskey ESOP trial

Post-trial briefs in last year’s Acosta v. Vinoskey ESOP case reveal insights into how each side shaped the valuation narrative. The trustee had launched a partly successful Daubert attack on the Department of Labor’s damages expert testimony, but the DOL’s overpayment claim survived and went to trial.

In late 2010, the owners of a Virginia company sold the remaining 52% of their company stock to an ESOP for $406 per share. In 2009, the stock was valued at $285 per share. The DOL argues the $406-per-share price exceeded fair market value. In agreeing to the transaction, the independent trustee, tasked with representing the interests of the ESOP, caused the plan to overpay. Accordingly, it breached its fiduciary duties. The DOL claims the sales price was “predetermined.” The trustee offered it before the ESOP appraiser even finished his valuation; it made no effort to negotiate a lower price. The DOL calls the trustee’s due diligence “rushed and cursory” and says the defendants engaged in “machinations” to “give a false impression of a diligent process.”

Inflating value of stock: According to the DOL’s trial damages expert, the ESOP appraiser “artificially inflate[d] the stock price.” The appraiser did this by manipulating the capitalization of earnings method—using earnings periods to measure the historical cash flows that were too short, adding back half of the company’s healthcare costs into the calculated cash flows even though this was not done in prior appraisals, using an unreasonably low discount rate as well as an unreasonable high long-term growth rate, and including excess cash and the value of land assets when they had been excluded in earlier appraisals. The ESOP paid a control premium but did not in fact obtain control in the acquisition; the appraiser should have applied a lack of control discount, the DOL claims. In sum, the ESOP paid $20.7 million for stock that was worth about $9.2 million. The DOL asks the court to restore to the ESOP over $11.5 million in losses and prohibit the defendants from serving as ERISA trustees in the future.

DOL expert’s ‘patently unreasonable’ valuation: In countering the DOL’s valuation arguments, the defense notes the company owned land and property worth about $8.8 million. The company averaged more than $4 million in annual profits in each of the previous five years. By November 2010, when the transaction was in process, the company had generated $4.8 million in profit. According to the defense, the trustee’s due diligence was a “thorough, documented process.” Further, the trustee used “an extremely respected independent valuation firm.” In contrast, the DOL’s damages expert presented a “patently unreasonable” valuation that “contains mathematic and factual errors.” The DOL expert offered a view of control “that is contrary to law and the Department of Labor’s own guidance, is undermined by his own opinions in other ESOP cases and does not adhere to any valuation standards.” The defense maintains the court cannot rely on this expert opinion “riddled with errors and inconsistencies” and asks the court to rule in favor of the defense.

Stay tuned for the court’s decision.

Thank you to Jim Joyner (Integra Benefits Consulting LLC) for alerting us to the parties’ post-trial filings.

Extra: The parties’ briefs are available as free downloads here.

|

|

Private-company EBITDA multiples rise in the second half of 2018

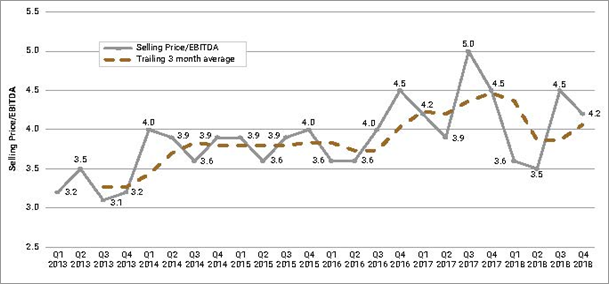

After being down sharply in 2Q18, EBITDA multiples (median selling price/EBITDA) across all industries increased to 4.5x and 4.2x in the third and fourth quarters of 2018, respectively, according to the BVR’s DealStats Value Index (DVI). In addition, the trailing three-month average for multiples has increased in the third and fourth quarters after trending downward in the prior two quarters (see graph).

Click here to view full size graph

The DealStats Value Index (DVI) summarizes valuation multiples and profit margins for private companies that were sold over the past several quarters. The DVI is a quarterly newsletter and is complementary with a subscription to DealStats. |

|

Take a fresh look at IRS data on healthcare organizations

Over the past few years, the IRS has become a treasure trove of financial information regarding nonprofit healthcare organizations. In 2016, the IRS started to release Form 990 data in machine readable format, says Nicholas Newsad (Healthcare Transaction Advisors LLC). This includes financial statements, payments to major vendors and related parties, and employee compensation data. The compensation data are particularly valuable, Newsad says, because they show compensation for various types of employees including officers and directors, trustees, and key employees. This all adds up to about 1.3 million employee compensation data points going back to 2011. IRC Section 501(c)(3) organizations are required to make their Forms 990 available for public inspection, and the IRS releases new Form 990 data every month.

Speaking on a recent webinar with Timothy Smith (TS Healthcare Consulting), Newsad pointed out that about 49% of hospitals in the U.S. are nonprofit organizations as well as about 20% of nursing facilities and 10% of all home health agencies. The webinar, Using Government Data Sources to Revolutionize Healthcare Valuation, reveals other industry data that have recently emerged that can be used in healthcare valuation. |

|

Deloitte examines M&A trends for 2019

Tax reform, a more relaxed U.S. regulatory climate, and growing cash reserves fuel optimism among U.S. dealmakers, according to a Deloitte report, “The State of the Deal - M&A Trends 2019.” A recent uptick in merger and acquisition (M&A) activity shows no signs of slowing down, the report says. In this year’s survey, 79% of respondents expect the number of deals they close in the next 12 months to increase, up from 70% last year.

|

|

Date set for NYSSCPA Business Valuation Conference

We see that this year’s Business Valuation Conference put on by the New York State Society of CPAs will be held May 20 in New York City. We make it a point to go to this conference every year because there’s always a slate of top-notch speakers and a mix of interesting topics. See you there! |

|

Recording available of Hitchner's 2018

BV highlights

Jim Hitchner (Valuation Products and Services) does an annual rundown of the prior year’s new need-to-know BV concepts, data, models, and methods (see our coverage of his latest update). A recording is now available of the two-hour presentation, in which he covers a variety of topics, including:

- Data updates, including the relaunch of Pratt’s Stats as DealStats and a new database for BV/M&A research (MergerShark);

- Platforms for estimating the cost of capital, including BVR’s new Cost of Capital Professional and updates to the Duff & Phelps Cost of Capital Navigator; also, whether the size premium really exists;

- A summary of the impacts of the Tax Cuts and Jobs Act (TCJA) on valuation and whether the so-called S corp premium has survived;

- A recent controversy over calculation engagements;

- Cross-examination tips from a conference session by Harold Martin (Keiter); and

- Some new “best” practices for the income approach.

Extra: Don’t miss Hitchner at the AAML/BVR National Divorce Conference on “How to Rig a Valuation in a Marital Dispute?” and “Cost of Capital: 20 Different Ways.”

|

|

Updated Business Reference Guide available

Now in its 29th year, the Business Reference Guide (BRG) has been updated for 2019. It contains the latest industry-related information including “rules of thumb,” pricing tips, benchmarking information with comparison data, industry resources, and general industry data on over 600 types of businesses. There’s also an online version with a fully searchable database, and it includes the print version of the guide. |

|

Celebrity brand value in India

Virat Kohli, captain of the Indian cricket team and a youth icon, has topped the powerful celebrity brand list of Duff & Phelps for the second year in a row, according to its Celebrity Brand Valuation Report: “The Bold, the Beautiful and the Brilliant.” The report is a deep analysis of how endorsements affect the brand value of celebrities alongside other factors such as age, fees charged per endorsement, social media presence, and the like. Kohli has a brand valuation of $170.9 million followed by Bollywood actress Deepika Padukone, at $102.5 million. No other celeb in India has a brand value of $100 million or more. |

|

BV movers . . .

People: John-Henry Eversgerd and Fiona Hansen, both formerly with EY and Deloitte, have spearheaded the launch of FTI Consulting’s valuation practice in Australia; FTI now has over 100 valuation professionals throughout Europe, the Americas, the Middle East, Africa, and Asia … Robert Carter, MS, CPA/CFF, CVA, CFE, CEPA, is now a partner at Hertzbach & Co. PA; he joined the firm in 2007 and manages the Litigation, Forensic, and Valuation Department … Matthew Blewitt, CPA, CVA, has been elected a shareholder at Maloney + Novotny’s Cleveland office; he started there in 2005, and his focus is on manufacturing, distribution, and service-based privately held companies … Kemp Moyer has joined San Francisco-based BPM LLP as a senior manager as the firm expands its valuation practice; he was formerly with Armanino LLP and Financial Strategies Consulting Group.

Firms: Englewood, Colo.-based Richey May & Co. has acquired Amata Solutions, a provider of customized planning and business intelligence tools for mortgage lenders … Calvetti Ferguson of Houston has acquired the North Dallas firm Mayrath & Co. PC; the combined firm has more than 100 professionals across six office locations … The partners and staff of the Canton, Ohio-based Smith Barta & Co. have joined Maloney + Novotny LLC; the firm now has over 140 service professionals in its Cleveland headquarters and offices in Canton, Columbus, Delaware, and Elyria … Withum has expanded its Cyber-Intelligence Advisory and Forensics and Valuation Services to include a dedicated team of information security and risk professionals providing CFI and e-discovery services.

Please send your professional and firm news to us at editor@bvresources.com. |

|

Upcoming BVR training events

- The Valuation of Private Debt Investments:

A Fair Value Update (February 12), with Antonella Puca (BlueVal Group LLC) and Andreas Dal Santo (BlueVal Group LLC).

Based on new guidance, learn about the valuation methodologies that are suitable for private debt investments and hear the key provisions of the guidance as they apply to private debt.

- Valuation and the IRS: Update for 2019

(February 14), with Michael Gregory

(Michael Gregory Consulting).

What are the top three business valuation appraisal audit areas now on the IRS’s radar? What action steps should you take if your appraisal gets picked for audit? A former IRS manager reveals the answers.

|

|

New and trending LinkedIn discussions

The Absence of a Size Effect Relevant to the Cost of Equity

Is a Merger Causing a Culture Clash in Your Organization?

OPM Backsolve and Convertible Debt Financing

Your discussion could be featured here—BVR’s LinkedIn group is a place for valuation professionals to share, discuss, and learn about compelling BV topics. If you’re not already a member, request to join today. |

|

We welcome your feedback and comments. Contact Andy Dzamba (Executive Editor) or Sylvia Golden, Esq. (Executive Legal Editor) at: info@bvresources.com. |

|

|

|

Business Valuation Resources, LLC

111 SW Columbia Street, Suite 750, Portland, OR 97201

1-503-479-8200 | info@bvresources.com

© 2019. All rights reserved.

|

|