Business Valuation Update

SEARCH BVU ISSUES/ARTICLES/CASES >>

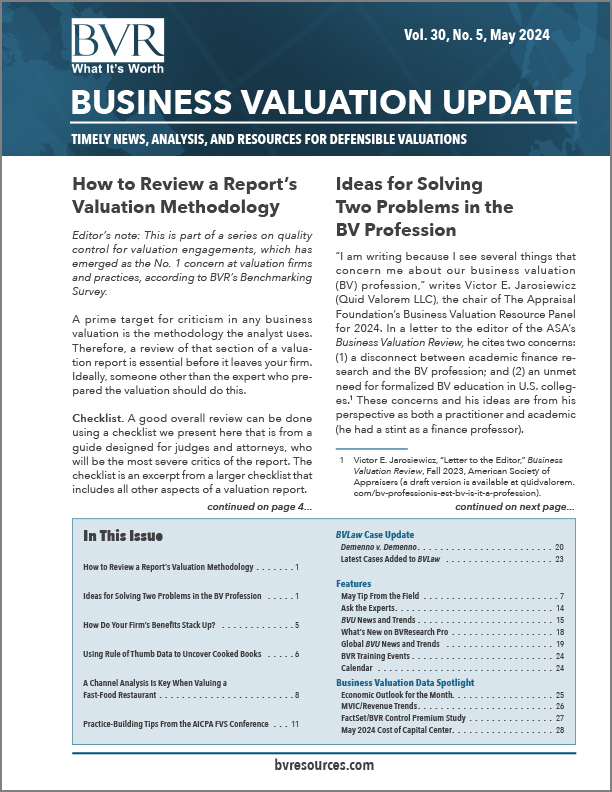

The Business Valuation Update (BVU) has been the voice of the valuation profession since its inception in 1995. Each monthly issue includes new thinking from leading professionals, detailed reports from valuation conferences, analysis of new business valuation approaches, brief analysis of “landmark” legal cases in key business valuation issues, regulatory and standards updates, and much more!

BONUS: Includes powerful online search functionality of all issues dating back to 1995 by keyword or author. Request a demo to see it in action!

"The Business Valuation Update helps me stay current with developments in the profession." -- Gary Wahlgren, MBA, CFA, Wahlgren Consulting, LLC

Additional Product Details

The Business Valuation Update is a must-have for any business valuation professional.

- Take advantage of new features including: Tips From the Field, Ask the Experts, BV News At-a-Glance, Cost of Capital center, and more!

- Keep yourself front and center of the business valuation profession with online access to all current and historical articles published in the BVU since 1995

- Save time with our state-of-the-art search functionality. Search by keyword or author

- Utilize cost of capital highlights printed on the back cover of every issue

- Get a special summary of BVR’s monthly Economic Outlook Update created specifically for BVU subscribers – includes historical economic data and forecast charts

- Bulletproof your valuation conclusion by incorporating the latest research and findings in your report or expert witness testimony

Editorial Board

Business Valuation Update has earned its acclaim in the profession in large part due to the ongoing efforts and contributions of our Editorial Board members. The Board helps keep our fingers on the pulse of industry developments and ensures every monthly issue is the top-notch publication our readers expect to receive.

R. James Alerding, CPA/ABV

R. James Alerding, CPA/ABVR. James "Jim" Alerding founded Alerding Consulting, LLC. As the owner and sole professional for Alerding Consulting, Alerding consults with Business Valuation Professionals as to various valuation and litigation projects. Alerding also lectures nationally, conducts and participates in webinars nationally, and writes articles and books on valuation and litigation subjects.

Prior to founding Alerding Consulting, Alerding practiced as a BV Professional for over thirty years with Blue & Co., LLP and Clifton Gunderson, LLP. During that career, Alerding testified in trials over 350 times and in depositions another 200 to 300 times. Alerding has been a CPA since 1969 and was a former member of the AICPA Business Valuation Committee. Alerding was also a member of the Writing Task Force which developed the SSVS#1, and was inducted into the AICPA Business Valuation Hall of Fame.

Alerding received his BS in Accounting, Summa Cum Laude, from Xavier University in 1967. Alerding is a co-author of Financial Valuation: Applications and Models, and has authored or co-authored four other books on business valuation related topics.

Christine Baker, CPA/ABV/CFF

Christine Baker, CPA/ABV/CFFChristine L. Baker is a Principal in the New York office of ParenteBeard LLC. With 18 years of experience, her expertise includes private business valuations and litigation support services. She has performed hundreds of valuations of businesses and business interests, and has provided valuation and dispute resolution, forensic accounting, and litigation support services for matters involving marital dissolution, shareholder and partnership disputes, and commercial litigation. She also has extensive experience with valuation matters such as Subchapter S elections, estate and gift planning, and strategic business planning and has provided expert testimony in Michigan, Illinois, Wisconsin, and Connecticut.

A lecturer of national renown, Christine is looked to by her peers and other experts as a leading instructor in the field of valuation and related topics. Her audiences have included the American Institute of Certified Public Accountants (AICPA), the New York State Society of CPAs (NYSSCPA), the Michigan Association of CPAs (MACPA), the American Bar Association (ABA), and the Michigan Bar Association (MBA). She has served as a faculty member for Michigan's Institute of Continuing Legal Education (ICLE).

Christine earned a B.A. in Business Administration with concentrations in Accounting and Computer Science from Hope College in Holland, Michigan. As instructor and participant, she completes at least forty hours of continuing professional education every year in topics such as business valuation, litigation support, forensic accounting, accounting and auditing, and professional ethics.

As member of the American Institute of Certified Public Accountants (AICPA) and the Michigan Association of CPAs (MACPA), she has served her peers in a leadership capacity on the AICPA Business Valuation Committee (2003-2005), the AICPA ABV Credential Committee (2006, 2007), the AICPA National Business Valuation Conference planning committee (2006, 2007, 2010), the MACPA Litigation and Business Valuation Task Force and most recently the AICPA Forensic and Valuation Services Executive Committee (2008- 2010). She participated in drafting AICPA Statement on Standards for Valuation Services No. 1 issued in 2007 and was named Business Valuation Volunteer of the Year in 2006.

She is a member of the McKinsey Quarterly Online Executive Panel, is a member of the Editorial Advisory Board of Business Valuation Update (published by Business Valuation Resources), and sits on the Valuation Editorial Board of Trusts & Estates Magazine.

Neil J Beaton, CPA/ABV, CFA, ASA

Neil J Beaton, CPA/ABV, CFA, ASA

As Managing Director at Alvarez and Marsal Mr. Beaton specializes in the valuation of public and privately-held businesses and intangible assets for purposes of litigation support (marriage dissolutions, lost profits claims and others), acquisitions, sales, buy-sell agreements, ESOPs, incentive stock options, and estate planning and taxation. He also performs economic analysis for personal injury claims, wrongful termination and wrongful death actions.

Prior to joining Alvarez and Marsal Mr. Beaton was Partner in Charge of Grant Thornton LLP's Valuation Services Group, and, prior to that, a Partner and shareholder at Brueggeman and Johnson, P.C., an independent valuation and litigation support firm. He was also a National Business Analyst with Dun & Bradstreet Corporation, where he was responsible for analyzing large, publicly traded corporations and assisting in large-scale credit decisions. He specialized in the banking, insurance and financial services industries.

Mr. Beaton holds a Master of Business Administration in Finance from National University and a Bachelor of Arts Degree in Economics from Stanford University. He has also completed specific coursework covering the financial analysis of banks and insurance companies and numerous continuing education classes in the areas of accounting, taxation and business valuation. In addition, he has completed the American Society of Appraisers' Business Valuation Courses, Levels I–IV.

John Bogdanski, Attorney at Law

John Bogdanski, Attorney at Law

Professor Bogdanski practiced in Portland as a partner at Stoel Rives. He has taught at Lewis & Clark since leaving practice in 1986. In the fall of 1992 he was a visiting professor of law at Stanford University. He is a five-time winner of Lewis & Clark's Leo Levenson Award for excellence in law teaching, which was most recently bestowed upon him by the class of 2003. He supervises the school's tax moot court team that has won national honors, and he founded and runs a volunteer clinic to assist international students with U.S. tax issues.

Bogdanski is a former member of the Commissioner's Advisory Group of the U.S. Internal Revenue Service. He is the author of the treatise Federal Tax Valuation and the editor-in-chief of the bimonthly journal Valuation Strategies. He has written many articles on federal tax law, and he is currently the Closely Held Business and Valuation columnist for Estate Planning magazine. He has been a frequent speaker at continuing education programs on tax law. He is an arbitrator for the National Association of Securities Dealers. He is admitted to the U.S. Tax Court Bar and the Oregon and California state bars.

Rod Burkert

Rod Burkert

Rod Burkert is the founder of Burkert Valuation Advisors, LLC, a business valuation and litigation support firm. Rod performs appraisals for companies operating in a wide variety of industries. His assignments focus primarily on valuations for income/gift/estate situations, divorce proceedings, partner/ shareholder disputes, and commercial damage/economic loss matters. He also provides independent report review and project consulting services to assist attorneys and fellow practitioners with their engagements.

Between 1996 and 2005, Rod was a member of and a lead instructor for NACVA's Consultants Training Institute, which develops and presents professional education courses on business valuation and related practice areas at training centers throughout the United States. Missing the classroom environment, he rejoined NACVA's teaching circuit in 2011. Rod is a recipient of various NACVA instructor awards, including Circle of Light (the highest distinction given to NACVA instructors) and Instructor of the Year, and has been named one of NACVA's Outstanding Members. He is also a past chairman of NACVA's Executive Advisory Board and Education Board.

Rod has lectured on valuation matters for the AICPA, ASA, ALI-ABA, state CPA societies, chambers of commerce, estate planning councils, bar associations, law firms, and private banking groups. He has authored several valuation articles that have been accepted for publication in various professional journals and is a regular contributing author to Business Valuation Update, The Value Examiner, and Financial Valuation and Litigation Expert.

Dr. Michael A. Crain, CPA/ABV, CFA, CFE

Dr. Michael A. Crain, CPA/ABV, CFA, CFE

Michael A. Crain (Florida Atlantic University) of Boca Raton, Florida is both an academic and a practitioner. Mike received his Doctor of Business Administration (finance) degree from Manchester Business School in England at the University of Manchester. He has been a licensed CPA and practitioner for over 30 years and holds several certifications in valuation: Accredited in Business Valuation (ABV) from the American Institute of CPAs and the designation of Chartered Financial Analyst (CFA) from the CFA Institute. He also holds the designation of Certified Fraud Examiner (CFE) from the Association of Certified Fraud Examiners. Mike is a past chairman of the AICPA’s Business Valuation committee and has been inducted into the AICPA Business Valuation Hall of Fame. He is a recipient of AICPA's Lawler Award presented by Journal of Accountancy for best article of the year and AICPA’s Sustained Contribution Award.

In addition to his work in teaching and director of FAU’s Center for Forensic Accounting, Mike consults with clients and is senior advisor to Miami-based Kaufman Rossin. In his consulting. Mike works largely in the areas of business/economic damage measurement, valuation of businesses and financial assets, and forensic accounting. He has served as a consulting and testifying expert in many commercial cases working for both plaintiffs and defendants in state and Federal courts. He has also served as an arbitrator in commercial damages and minority shareholder cases and as a court-appointed accountant. Moreover, Mike has previously worked in the auditing and consulting areas in public accounting firms including an international firm where he was a senior manager Mark O. Dietrich, CPA

Mark O. Dietrich, CPA

Mark O. Dietrich, CPA/ABV, is editor, technical editor, and contributing author to the Business Valuation Resources (BVR)/American Health Lawyers' Association (AHLA) Guide to Healthcare Valuation, 4th edition (2016), editor and principal author of BVR’s Guide to Physician Practice Valuation, 3rd Edition (2016), co-editor and contributing author of the BVR/AHLA Guide to Healthcare Industry Compensation and Valuation, 2nd edition (2016) and co-author with Gregory Anderson, CPA, CVA, of The Financial Professional's Guide to Healthcare Reform, published by John Wiley & Sons. Mark is also author of the Medical Practice Valuation Guidebook and co-author of PPC's Guide to Healthcare Consulting, along with more than 100 articles on valuation, taxation, managed care, and the healthcare regulatory environment. He serves as Of Counsel to Meyers, Harrison & Pia. Mark's career experience includes serving as partner-in-charge of the annual audit of an 80 physician tax-exempt faculty group practice, representation of tax-exempt and taxable entities in Internal Revenue Service field audits, participation in the development of a 250-physician independent network and negotiation of its managed care and Medicare Advantage contracts, and more than 400 valuation engagements in the healthcare industry.

A regular speaker at national conferences on healthcare valuation and other topics, Mark also has lectured in the United Kingdom during 2009, 2011, 2012 and 2014 on managed care, healthcare valuation, and valuation of medical practices to Her Majesty's Revenue and Customs. He is a member of the editorial board of Financial Valuation and Litigation Expert and chaired the AICPA's National Healthcare Industry Conference Committee in 2012 and 2013. Mark has also served on the AICPA's ABV Credential Committee and ABV Exam Review Course Task Force.

John-Henry Eversgerd, CFA, ASA

John-Henry Eversgerd, CFA, ASA

John-Henry is a valuation specialist and expert witness with the firm of Hewlett & Murray, which is headquartered in Bondi, Australia and has operations in Sydney, Melbourne and Brisbane. He has over 25 years of experience in corporate finance and valuations for transactions, strategy, disputes, and financial reporting, regulatory and tax compliance. John-Henry specializes in the valuation of commercial damages, shares, businesses, intellectual property, goodwill, contracts, debt, complex securities, and other investment instruments.

After gaining significant experience in New York, he transferred to Australia in 2008. From 2012 to 2014 he was Chair of Chartered Accountants Australia and New Zealand’s NSW chapter of the Business Valuation Special Interest Group. He was an Honorary Associate of Macquarie University's Applied Finance Centre and is currently an Editorial Advisory Board Member of Business Valuation Resources, a monthly international journal providing technical articles for the valuation industry.

John-Henry has lectured on valuation and forensic accounting topics at the University of Melbourne and has presented at legal and accounting conferences and the Victorian Bar Association, Chartered Accountants Australia and New Zealand (CAANZ), and Certified Practising Accountants (CPA) Australia.

He regularly provides expert evidence for court, mediation, and arbitration.

Nancy J Fannon, CPA, ASA, MCBA (Emeritus)

Nancy J Fannon, CPA, ASA, MCBA (Emeritus)

Nancy J. Fannon is formerly the Partner in Charge of Litigation Services at Meyers, Harrison & Pia, LLC, a firm specializing in business valuation, economic damages, and litigation support services. Ms. Fannon has over 25 years of professional valuation and damages experience, and is frequently retained to provide expert witness services relating to the value of a business; an opinion on the amount of financial damages for the lost profits or the loss of a business or segment of a business; a determination of reasonable compensation; and other financial matters. Ms. Fannon is a frequent local and national speaker on the topics of business valuation and damages. She is a regular contributing author and editorial board member for several national valuation and financial expert journals, and has written and/or technically reviewed several valuation and commercial damage textbooks. In 2007 and 2008 she published two professional reference books on valuation. The Comprehensive Guide to Economic Damages is the fourth edition of her most recent publication.

Jay E Fishman, FASA, FRICS

Jay E Fishman, FASA, FRICS

Jay E. Fishman, FASA, is a managing director of Financial Research Associates and has been actively engaged in the appraisal profession since 1974. He specializes in the valuations of business enterprises and their intangible assets. Fishman has co-written several books, including the highly acclaimed Guide to Business Valuations (with Shannon Pratt and James Hitchner)and Standards of Value (with Shannon Pratt and William Morrison). He has also written numerous articles on business valuations as well as qualifying as an expert witness and providing testimony in 12 states. He has taught courses on business valuation to the Internal Revenue Service, the National Judicial College, the Hong Kong Society of Accountants, and on behalf of the World Bank in St. Petersburg, Russia. He recently taught courses in Moscow, Russia, for Kwinto Management and for the Slovenian Institute of Auditors in Ljubljana, Slovenia.

He holds a bachelor’s and master’s degree from Temple University as well as an MBA from LaSalle University. Fishman is a Fellow of the American Society of Appraisers, a Fellow of the Royal Institution of Chartered Surveyors, a former chairman of the Business Valuation Committee of the American Society of Appraisers, editor of the Business Valuation Review, an editorial advisory board member of Business Valuation Update, chair of ASA’s Government Relations Committee, a former trustee of The Appraisal Foundation, and is a member of the Appraisal Standards Board of The Appraisal Foundation. He finished his term as a member of the Appraisal Practice Board of The Appraisal Foundation in July 2016. He recently was awarded the Chairman’s Public Service Award from The Appraisal Foundation. The award was established in 2005 to recognize individuals who have worked with the foundation for the benefit of the appraisal profession and who, in the process, have gone above and beyond the call of duty. Fishman was recently appointed as a member of the board of trustees of the International Valuation Standards Council (IVSC).

Lynne Z. Gold-Bikin, Attorney at Law (In Memoriam)

Lynne was a nationally renowned family law attorney who frequently appeared on the major networks and was quoted in prominent newspapers and magazines discussing domestic issues. She won numerous awards and literally wrote the book on divorce law in 1994 when her "Divorce Practice Handbook" was published.

She taught at the Houston Family Law Trial Institute in South Texas College of Law and gave seminars for the Pennsylvania Bar Institute. Her awards included 50 Best Business Women in Pennsylvania, KYW Women of Achievement Award and the Pennsylvania Honor Roll of Women Award. In 2014, Lynne received the Eric Turner Memorial Award from the Family Law Section of the Pennsylvania Bar Association in honor of her 40 years of exceptional work and her teaching others in the field.

Lance Hall, ASA

Lance Hall, ASA

Lance Hall is a Senior Advisor in Stout Risus Ross's Valuation & Financial Opinions Group. He has extensive experience in a broad and diverse range of valuation assignments for purposes that include estate and gift tax, transaction fairness, litigation, as well as corporate and personal income tax.

Mr. Hall is a valuation professional with three decades of experience in all facets of valuation and related issues. Nationally known as an authority in his field, Mr. Hall has also been recognized by the National Association of Certified Valuation Analysts (NACVA) as an "Industry Titan" for his contributions to the valuation industry. He is an expert in securities design, fractional interests in real estate, minority interest discounts, discounts for lack of marketability, as well as Rule 144 and other such restricted securities, and he has substantial experience with issues of solvency, fairness, and employee stock ownership plans (ESOPs).

A prolific author and expert witness, Mr. Hall is also a sought after speaker, known for his exciting and dynamic presentations, his in-depth knowledge, and his analytical perspectives on current valuation issues. He regularly shares his expertise on a broad range of topics relative to complex valuations, estate and gift tax issues, and court case analyses, as well as mergers and acquisitions, in presentations at professional conferences, in seminars and webinars, and in media interviews nationwide. He also frequently authors articles for prominent valuation publications – among these, Valuation Strategies, Trusts & Estates, and Business Valuation Resources. Mr. Hall is also a member of the Panel of Experts of Financial Valuation and Litigation Expert. His media coverage includes: The New York Times, Fox Business Live, Los Angeles Times, Forbes, The Wall Street Journal, Fox Business This Morning and Business Week.

Prior to joining Stout, Mr. Hall founded FMV Opinions, where he oversaw the operations of the firm from the Irvine, California office.

Mr. Hall received his Master's degree in Business Administration from Brigham Young University, and his Bachelor of Business Administration degree from the University of North Texas. He is an Accredited Senior Appraiser (ASA) of the American Society of Appraisers. Mr. Hall is a Series 7, 63, 79 and 99 Registered Securities Representative, and a Series 24 Principal.

Ted D Israel, CPA/ABV/CFF

Ted D Israel, CPA/ABV/CFF

Ted Israel is a founding partner of Israel Frey Group, LLP (San Rafael, CA), a firm specializing in forensic and valuation services as well as ownership transition and succession planning. He was formerly with Eckhoff Accountancy Corporation, where he was in charge of forensic and valuation services. He provides business valuation services in estate and gift matters, mergers and acquisitions, and corporate and marital dissolutions.

He has testified for individual parties and as a court appointed expert in marital dissolutions on the character of assets, the valuation and character of businesses, owners' compensation and reimbursements. He is a regular speaker on business valuation and family law topics to accountants' and attorneys' groups and the author of a number of articles.

Ted obtained a B. S. in Accounting from Golden Gate University. He is a member of CalCPA's Business Valuation Section (Chair 2004-2006), Family Law Section, CalCPA's Litigation Services Steering Committee and a member of the AICPA’s Business Valuation Committee (2014-2017). Ted lectured in the Department of Management Studies at Sonoma State University from 1982 to 1994 and has served as an instructor for the National Association of Certified Valuation Analysts.

Jared Kaplan, Attorney at Law (In Memoriam)

Harold Martin, Jr., CPA/ABV/CFF, ASA, CFE

Harold Martin, Jr., CPA/ABV/CFF, ASA, CFE

Harold is the partner-in-charge of valuation and forensic services for Keiter, a certified public accounting and consulting firm located in Richmond, Virginia. With over 30 years of experience in financial consulting, public accounting, and financial services, he has appeared as an expert witness in federal and state courts, and served as a federal court-appointed forensic accountant for receiverships and court-appointed neutral business appraiser and forensic accountant. He is also a adjunct faculty at The College of William and Mary Raymond A. Mason School of Business. He was previously affiliated with Coopers & Lybrand as a director responsible for managing the Richmond Financial Advisory Services practice, Price Waterhouse as a senior manager in management consulting services, and First & Merchants National Bank as a direct loan officer in retail banking.

Harold is a former member of the American Institute of Certified Public Accountants BV Committee, former Chair of the AICPA National BV Conference Steering Committee, former commissioner of the AICPA National Accreditation Commission, former editor of the AICPA ABV e-Alert, and former editorial adviser and contributing author for the AICPA CPA Expert. In 2012, he was inducted into the AICPA BV Hall of Fame in recognition of lifetime achievements and contributions which have significantly advanced the valuation discipline. He is also a two-time recipient of the AICPA BV Volunteer of the Year Award. He serves as an instructor for the AICPA National BV School, AICPA ABV Exam Review Course, and AICPA Expert Witness Skills Workshop. He is a former member of the Virginia Society of Certified Public Accountants Board of Directors and is the former chair of the Business Valuation and Litigation Services Committees. He created and chairs the VSCPA’s Annual BV, Fraud, and Litigation Services Conference. He is a frequent speaker and writer on valuation and forensic accounting topics. He is a co-author of Financial Valuation: Applications and Models, 1st – 4th ed. a contributing author to Cost of Capital: Estimation and Applications, 2nd - 4th ed., and an expert panelist for Financial Valuation and Litigation Expert.

Harold received his A.B. degree from The College of William and Mary and his M.B.A. degree from Virginia Commonwealth University where he was a member of Beta Alpha Psi (National Accounting Honorary).

Gilbert E Matthews, MBA, CFA

Gilbert E Matthews, MBA, CFA

Mr. Matthews joined Sutter Securities Incorporated in San Francisco as a Senior Managing Director in December 1995 and became Chairman in December 1997. From 1960 through 1995, Mr. Matthews was with Bear Stearns in New York. He was a Senior Managing Director from 1986 through 1995 and a Managing Director from 1985 (its incorporation) to 1986. He was a general partner of its predecessor partnership, Bear, Stearns & Co., from 1979, a limited partner from 1973 to 1979, and a vice president from 1969 to 1973. He was in the Corporate Finance Department from 1967 through 1995 and a security analyst from 1960 through 1967.

Mr. Matthews has more than 40 years of experience in investment banking, having worked with a wide variety of clients in mergers, acquisitions and divestitures, friendly and unfriendly tender offers, public offerings of debt and equity, recapitalizations, financial restructurings, and international transactions. From 1970 through 1995, he was Chairman of Bear Stearns' Valuation Committee, which was responsible for all opinions and valuations issued by the firm.

Mr. Matthews received an A.B. from Harvard in 1951 and an M.B.A. from Columbia in 1953. He is a member of the New York Society of Security Analysts and is a Chartered Financial Analyst.

Z. Christopher Mercer, ASA, CFA

Z. Christopher Mercer, ASA, CFA

Z. Christopher Mercer is founder and chief executive officer of Mercer Capital. Mercer Capital is a business valuation and investment banking firm serving a national and international clientele. In addition, Mercer Capital provides investment banking and corporate advisory services including sell-side and buy-side merger & acquisition representation, fairness opinions, solvency opinions, business interest and securities valuation, and board presentations, among others.

Mr. Mercer began his valuation career in the late 1970s. He has prepared, overseen, or contributed to hundreds, if not thousands, of valuations for purposes related to M&A, litigation, and tax, among others. He is a prolific author on valuation-related topics and one of the most sought after speakers on business valuation issues for national professional associations and other business and professional groups.

Mr. Mercer has broad industry experience providing corporate valuation and investment banking services to hundreds of companies in an array of industries. Specific industry experience includes, but is not limited to, auto dealerships, construction, general & specialty contracting, distribution companies, financial institutions, financial services, retail, manufacturing, restaurants, technology companies, telecommunications, trucking & transportation.

In addition to this publication, Mr. Mercer is the sole author of four books including Valuing Shareholder Cash Flows: Quantifying Marketability Discounts, Valuing Enterprise and Shareholder Cash Flows: The Integrated Theory of Business Valuation, Quantifying Marketability Discounts, and Valuing Financial Institutions. Mr. Mercer is also a contributing author to Valuation for Impairment Testing. He has also published scores of articles and given numerous speeches on topics related to business valuation and investment banking.

John Porter, Attorney at Law

John Porter, Attorney at Law

John Porter is a senior partner who handles federal gift, estate and income tax litigation and controversy work, including disputes and litigation with the Internal Revenue Service. He is nationally recognized for his expertise in representing taxpayers before and against the IRS in estate and gift tax controversies, especially those involving hard-to-value assets such as interests in family limited partnerships and limited liability companies.

Mr. Porter has served as lead counsel for taxpayers in numerous cases in the United States Tax Court, the Court of Federal Claims and United States District Courts and Courts of Appeals. He also has represented taxpayers in numerous other federal tax audits and administrative appeals. He frequently advises and represents fiduciaries and beneficiaries of trusts and estates with respect to administration and fiduciary duty issues. Mr. Porter is a Regent and a Fellow of the American College of Trust and Estate Counsel.

Jim Rigby, Jr., CPA/ABV, ASA (In Memoriam 1946 – 2009)

Jim Rigby, Jr., CPA/ABV, ASA (In Memoriam 1946 – 2009)

James S. Rigby, Jr., CPA/ABV, ASA was a managing director of The Financial Valuation Group (FVG) and president of The Financial Valuation Group of California, Inc.

Mr. Rigby had over 25 years of professional experience, including valuation related services and financial consulting. He provided expert testimony related to valuations and consulting services related to international expansions, mergers & acquisitions, intellectual property and strategic planning. He was bilingual, utilizing his English and Spanish throughout the American continents.

Mr. Rigby served on various business valuation/litigation committees of the American Institute of Certified Public Accountants, the American Society of Appraisers, and other professional associations. He was the co-author of multiple continuing education courses and articles published in a variety of professional journals. Mr. Rigby had a Bachelor of Science degree in Business Administration from Bryan College and a Masters of Business Administration degree from Woodbury University. He held the AICPA's Accreditation in Business Valuation (ABV) and also was an Accredited Senior Appraiser (ASA) with the American Society of Appraisers. He was a member of the AICPA's Business Valuation Hall of Fame.

Ronald L Seigneur, MBA, ASA, CPA/ABV, CVA

Ronald L Seigneur, MBA, ASA, CPA/ABV, CVA

Ron is Managing Partner of Seigneur Gustafson LLP CPAs, based in Lakewood Colorado, where he is responsible for financial forensics, economic damages assessments, business and intellectual property valuation, exit planning and related litigation support services. Ron holds the Accredited in Business Valuation (ABV), and Certified Global Management Accountant (CGMA) designations from the American Institute of Certified Public Accountants, the Certified Valuation Analyst (CVA) designation from the National Association of CVAs, and is a Senior Appraiser (ASA) with the American Society of Appraisers. He is co-author of the 1300+ page treatise on business appraisal titled Financial Valuations: Applications and Models, published by John Wiley & Sons in 2011, andReasonable Compensation: Applications and Analysis for Management, Valuation and Tax, published by Business Valuation Resources in 2010.

Ron is co-founder of YS Advisory, a consultancy focused on advising practitioners and attorneys on practice management and technical issues in the areas of business and IP appraisal, economic damages, financial forensics, malpractice issues and related concerns. He has been an adjunct professor at the University of Denver, College of Law for over 20 years, where he teaches law firm finance, leadership and management classes. He is a fellow of the College of Law Practice Management and a frequent speaker and author on valuation, economic damages, leadership, and other professional firm practice management topics. Ron was the 2009-10 chair of the Colorado Society of CPAs and was inducted into the AICPA Business Valuation Hall of Fame in 2006.

Lisa Ann Sharpe, J.D.

Lisa Ann Sharpe, J.D.

Lisa Ann Sharpe has been in private practice in Seattle for over 28 years, focusing primarily on complex domestic matters. Lisa received her B.A. in business administration (Finance) from the University of Washington and her J.D. from the University of San Diego. Lisa is a member of the Washington State Bar Association and the California Bar Association. She is a Fellow of the American Academy of Matrimonial Lawyers and is a former past president of the Washington State Chapter. She has been selected by Law and Politics as a Washington State Super Lawyer® annually since 2010 and has been selected as a Best Lawyer® in the area of family law for Seattle annually since 2015. She was named by Law and Politics/Super Lawyers as one of “Washington State’s Top 50 Women Lawyers” from 2012 through 2019 and selected as one of the top 100 lawyers in both 2016 and 2017. Lisa is a member of the American Bar Association and a frequent speaker on financial issues at family law seminars. She will be co-chairing the BVR/AAML conference in September 2020. She holds a Martindale-Hubbell highest AV preeminent rating.

Andrew Z. Soshnick, Esq.

Andrew Z. Soshnick, Esq.

Drew is currently a partner at Faegre Drinker. When individuals face complex personal financial issues, Drew Soshnick is there to offer steady and effective counsel. Drew is a trial lawyer with broad experience representing high net worth business owners, executives, professionals, athletes, celebrities, public figures or their spouses in divorce and other family matters involving sophisticated valuation issues. Drew also actively advises clients in business disputes .Drew collaborates closely with a vast array of Faegre Drinker's corporate, financial services, entrepreneurial services, taxation, estate planning and real estate professionals to provide individuals comprehensive personal and business-oriented services.

Andrew Strickland, FCA

Andrew Strickland, FCA

Andrew Strickland is currently a Consultant with Scrutton Bland Chartered Accountants (UK). He holds a FCA, which is Fellow of the Institute of Chartered Accountants in England and Wales (ICAEW), and he has a Master of Arts History from Cambridge University. Andrew is a member of the Valuation Committee of the ICAEW and has completed the ASA’s BV101 and BV102 courses.

Andrew has had articles published in Taxation, a UK magazine on tax and valuation matters, including an article on the control premium in UK valuation. He co-authored (with Bob Dohmeyer) an article in Business Valuation Update on the bid premium and its misuse for determining minority discounts. He is also a regular contributor to the newsletter issued by the valuation committee of the ICAEW to its members. He has also made presentations at the annual valuation conference of the ICAEW on the control premium, on the implied private company pricing line (IPCPL) and a case study on the valuation of a private company. Andrew has been a contributing member of the Education Committee of the International Institute of Business Valuers (IIBV) and is now the committee’s current chair.

Jeff Tarbell, ASA, CFA

Jeff Tarbell, ASA, CFA

Jeffrey Tarbell is a Director in Houlihan Lokey's Financial Advisory Services business. He has more than two decades of experience providing valuation and financial opinions to private and publicly traded companies. He is Head of the firm's Estate and Gift Tax Valuation practice, Co-Head of the firm's Employee Stock Ownership Plan Valuation practice, and a member of the firm's Technical Standards Committee. He is based in the firm's San Francisco office.

Before joining Houlihan Lokey, Mr. Tarbell was a principal and national director of financial advisory services for a national valuation firm. Earlier, he was a vice president in the M&A group of a boutique investment banking firm.

Mr. Tarbell speaks frequently on securities valuation, capital markets and other financial issues. He develops and teaches valuation content for the American Society of Appraisers, undergraduate- and graduate-level university courses, a Big Four accounting firm, and law firms. He has served as a reviewer, editor, contributing author or technical advisor for several valuation textbooks and publications, including the forthcoming Cost of Capital: Applications and Examples, 5th ed., by Shannon P. Pratt and Roger J. Grabowski (Wiley Finance, 2013). He is also a member of the Editorial Advisory Board of Business Valuation Update. He has testified in various legal forums, including state and federal courts, the United States Tax Court, a congressional hearing, a Department of Labor panel, as well as in arbitration, mediation and deposition proceedings. He also frequently serves as a consultant to lawyers during litigation and dispute resolution.

Mr. Tarbell earned a B.S. from the University of Oregon and an MBA from the University of Chicago Booth School of Business. He is an accredited senior appraiser (ASA), certified in business valuation, of the American Society of Appraisers and a member of the Executive Committee of its Business Valuation Committee. He holds the designation of Chartered Financial Analyst (CFA) of the CFA Institute. He is a member of the Executive Committee of the International Institute of Business Valuers (IIBV) and the Board of Directors of the Valuation Roundtable of San Francisco. He is the chair of the Valuation Advisory Committee of The ESOP Association and a member of its Board of Governors. He is also a member of the Portland Society of Financial Analysts and an associate member of the National Association of Corporation Directors and the American Bar Association.

Edwina Tam, CA, CPA, CBV, ASA

Edwina Tam, CA, CPA, CBV, ASA

Edwina Tam is a partner of Deloitte in Hong Kong specializing in business and intangible asset valuations and corporate reorganization for both public and privately held entities. Her focus is on mergers and acquisitions, strategic planning, financial statement reporting including purchase price allocation under HKFRS/IFRS and US GAAP, tax reorganization, and litigation support. Her industry experience includes private equity, financial services, insurance, telecommunications, oil & gas, healthcare, retail food, alternative power, retail pharmacy, manufacturing, and property.

Prior to her specialization in business valuations, Edwina focused on tax and estate planning for small and medium enterprises and provided services in personal, corporate and trust tax, and tax planning in Toronto.

Edwina currently serves on the APEC/IVSC Taskforce focused on improving valuation practices in the APEC region and she is board chair of the International Institute of Business Valuers (iiBV). She is a Chartered Professional Accountant/ Chartered Accountant (Chartered Professional Accountants Canada), a Chartered Business Valuator (Canadian Institute of Chartered Business Valuators) an Accredited Senior Appraiser in Business Valuation (American Society of Appraisers).

Gary Trugman, CPA/ABV, MCBA, ASA, MVS

Gary Trugman, CPA/ABV, MCBA, ASA, MVS

Gary R. Trugman is a Certified Public Accountant licensed in the states of Florida, New Jersey, and New York (inactive). He is Accredited in Business Valuation (ABV) by the American Institute of CPAs and is a Master Certified Business Appraiser (MCBA) as designated by The Institute of Business Appraisers Inc. He is also an Accredited Senior Appraiser (ASA) in Business Valuation by the American Society of Appraisers. Gary is regularly court appointed and has served as an expert witness in Federal court and state courts in several jurisdictions, testifying on business valuation, matrimonial matters, business and economic damages and other types of litigation matters.

Gary is the current Chairman of the International Ethics Committee and past-chair of the Business Valuation Education Subcommittee of the American Society of Appraisers. Gary was formerly on the American Institute of CPAs' ABV Examinations Task Force, Subcommittee Working with the Judiciary, ABV Credentials Committee, Executive Committee of the Management Consulting Services Division, and the Business Valuation and Appraisal Subcommittee. He is the former Chairman of the Florida Institute of CPAs' Litigation, Forensic Accounting and Valuation Services Section and was formerly on the New Jersey Society of CPAs' Litigation Services Committee, Business Valuation Subcommittee (past-chairman) and Matrimonial Committee.

Gary is former Chairman of the Ethics and Discipline Committee, and formerly served on the Qualifications Review Committee and is the former Regional Governor of the Mid-Atlantic Region of The Institute of Business Appraisers Inc. He has received a AFellow Award from The Institute of Business Appraisers Inc. for his many years of volunteer work in the profession. Gary has also received an AICPA AHall of Fame Award for his service to the accounting profession in assisting in the accreditation in business valuation process. Gary formerly served on the International Board of Examiners of the American Society of Appraisers. He is currently a faculty member of the National Judicial College, educating judges around the country.

Gary lectures nationally on business valuation topics. He is the author of a textbook entitled Understanding Business Valuation: A Practical Guide to Valuing Small to Medium-Sized Businesses, now in its 4th edition, and an e-book entitled Essentials of Valuing a Closely-Held Business, both published by the American Institute of CPAs. He has also developed numerous educational courses, including but not limited to, a six day business valuation educational series and a seminar entitled Understanding Business Valuation for the Practice of Law for the Institute of Continuing Legal Education. Gary also serves as an editorial advisor for the Journal of Accountancy, The CPA Expert, Business Valuation Update, and formerly for National Litigation Consultants' Review and the CPA Litigation Service Counselor. He has lectured in front of numerous groups and has been published in the Journal of Accountancy, FairShare and The CPA Litigation Service Counselor.

Gary was born in New York and received his undergraduate degree from The Bernard M. Baruch College of the City University of New York. He was the first business appraiser in the United States to earn a Masters in Valuation Sciences from Lindenwood College. His Masters Thesis topic was "Equitable Distribution Value of Closely Held Businesses and Professional Practices". Gary's appraisal education also includes various courses offered by The Institute of Business Appraisers, the American Society of Appraisers, the American Institute of CPAs and others. He has taught federal income taxation at Centenary College, financial statement analysis in the masters degree program at Lindenwood College, and several topics at the AICPA National Tax School in Champaign, Illinois. Gary is an adjunct professor teaching a valuation course at Florida International University. He is a member of The Institute of Business Appraisers Inc., the American Society of Appraisers, the American Institute of Certified Public Accountants, the Florida Institute of Certified Public Accountants and the New Jersey Society of Certified Public Accountants.

Kevin Yeanoplos, CPA/ABV/CFF, ASA

Kevin Yeanoplos, CPA/ABV/CFF, ASA

Kevin R. Yeanoplos is the Director of Valuation Services for Brueggeman and Johnson Yeanoplos, P.C., a firm with offices in Seattle, Washington, and Tucson, Arizona that specializes in the areas of business and intellectual property valuation, financial analysis and litigation support. Mr. Yeanoplos has extensive experience, having been involved in over 1,000 engagements for a variety of purposes, including divorce and other litigation, financial reporting, gift and estate taxes, mergers and acquisitions, and ESOP's.

He has determined the value of a broad spectrum of companies and intangibles in various industries, including aircraft parts manufacturers, biomedical companies, construction companies, automobile dealerships, telephone companies, restaurants, and various retailers. He has also valued various professional practices, including accounting firms, law firms, and medical and dental practices. Mr. Yeanoplos has evaluated economic loss suffered by parties in cases involving contract disputes, medical malpractice and wrongful termination.

Mr. Yeanoplos has testified as an expert witness in both state and Federal courts on a number of issues, including valuation, financial analysis, and damages. He has been a court appointed neutral on valuation issues. He has testified as an expert in Utah, Arizona, Colorado, Illinois, Tennessee, Washington, Florida, and Pennsylvania. He has been recognized as a leading expert in accounting/valuation by attorneys listed in The Best Lawyers in America as part of Best Lawyers Preferred.

Mr. Yeanoplos has considerable experience in lecturing to professionals on the topics of valuation, applied finance and financial analysis issues and theory. He has been a guest lecturer at the Thunderbird School of Management and the University of Arizona's Eller School of Business. He has taught courses in 75 cities in 37 states and the District of Columbia, as well as in Canada. He is currently a faculty member for the American Institute of CPAs' ("AICPA") National Business Valuation School.

He has authored and/or instructed programs for the AICPA, the Utah Association of CPAs ("UACPA"), the Arizona Society of CPAs ("ASCPA"), the American Society of Appraisers ("ASA"), the National Association of Certified Valuation Analysts ("NACVA"), the State Bar of Arizona, the Utah State Bar, and many other professional organizations. He is a past recipient of NACVA's Instructor of Distinction Award.

He co-authored the AICPA's Accredited in Business Valuation Exam Review Course, was a contributing author to the 2001 and 2008 Supplement to Valuing Professional Practices & Licenses, a contributing author to the 2004 Forensic Accounting in Matrimonial Divorce supplement to the Journal of Forensic Accounting, was a co-author of the 2006 Financial Valuation: Application and Models 2nd Edition, and was a co-author of the 2003, 2007 and 2009 Guide to Personal v. Enterprise Goodwill. He authored the AICPA's course on Auditing Fair Value Measurements. He is currently serving as a member of the Editorial Advisory Board of the Business Valuation Update. He is on the Panel of Experts for the Financial Valuation and Litigation Expert. He was a presenter at the 2001 Domestic Relations Conference sponsored by the Arizona Supreme Court.

Mr. Yeanoplos is currently serving as a Commissioner on the AICPA's National Accreditation Commission, a senior level executive committee. He is immediate past Chair of the AICPA's ABV Credential Committee and a former member of the AICPA's Virtual Grassroots Panel. He was named the AICPA's Business Valuation Volunteer of the Year in 2006. He served as a member of the AICPA's Consulting Services Business Valuation Committee and Chaired the AICPA's 2000 Annual Business Valuation Conference. He is currently a member of the Editorial Advisory Board for the AICPA's Journal of Accountancy.

He is a two-time past Chair of the ASCPA's Business Valuation Committee and was the founding Chair of the UACPA's Business Valuation Committee. Under his tenure as Business Valuation Committee Chairman, the ASCPA established their annual Business Valuation Conference, now in its eleventh year. In 2007, the ASCPA recognized Mr. Yeanoplos with an Award for his Dedication to the Success of Business Valuation Section.

Mr. Yeanoplos is a Certified Public Accountant Accredited in Business Valuation and Certified in Financial Forensics ("CPA/ABV/CFF") and was in the charter class of those earning the ABV credential and the CFF credential. In addition, he is an Accredited Senior Appraiser in the Business Valuation discipline for the American Society of Appraisers. He is a member of the American Arbitration Association's Commercial Panel. He is currently a member of the ASA's International Board of Examiners.

Mr. Yeanoplos graduated Magna Cum Laude from the University of Utah in 1983, where he received his Bachelor of Science degree in Accounting.