Practitioners weigh in on ongoing DLOM debates

BVWire’s coverage of recent developments in DLOM has sparked some lively discussions. The dialog over discounts in fair value proceedings involving dissenting shareholder appraisals and oppressed minority shareholder buyouts has spilled over into social media.

Bad behavior in NJ: Last week’s BVWire continued its reporting on the recent DLOM decision in the Wisniewski v. Walsh case, in which the misbehavior of one of the parties was a factor. In his blog, Chris Mercer (Mercer Capital) calls the case a “business appraiser’s nightmare” and says the DLOM rulings in the case reflect the trial court's preoccupation with equities rather than the economics of the business in play.

On BVR’s LinkedIn group, one commenter, Rick Warner (Great Lakes Valuations), says: “I have no issue with the court's decision here. The appraisers did what they were required to do, i.e., opine on the economics; the court did what it was required to do and make its decision based on the ‘fairness’ of the facts and the case. As long as the court is concerned with the ‘equity’ of the decision, this is as it should be.” Another commenter agrees. “The general point is that in a New Jersey Court of Equity, they are going to look at what is equitable, and if a party doesn't have ‘clean hands,’ they may pay a price for it,” says Ray ("RJ") Dragon (Siena Valuation LLC). “This is solid legal theory, in which judges are the experts. As valuation experts, we need to consider applicable law.”

Another commenter is troubled by the entire matter: “It's no wonder business appraisers are accused of inconsistently applying BV principles when two prominent BV appraisers apply a DLOM ranging from 0% to 35%,” says Greg Tesone (Center Point Business Valuations LLC). “How can this be? Is it a marketable interest or not?”

What are your thoughts? Join the BVR LinkedIn group—the discussion is “Bad Behavior DLOM in New Jersey.”

Across the river: In New York, the state’s out-of-step position with respect to DLOM in fair value proceedings is the subject of an article in the January issue of Business Valuation Update: “NY’s Unfair Application of Shareholder-Level Marketability Discounts,” (subscription required) by Gil Matthews (Sutter Securities). A blog post by attorney Peter Mahler (Farrell Fritz) in the New York Business Divorce blog questions Matthews’s views on corporate-level DLOMs.

William C. Quackenbush (Advent Valuation Advisors), former chair of the ASA's business valuation committee has written a follow-up article for the March issue of Business Valuation Update, in which he also talks about the “nearly schizophrenic trail of decisions over the past 20 years regarding DLOMs. I would argue that this case of schizophrenia is contagious with the court infected by BV testimony with the same symptoms. It is no wonder that Peter Mahler wishes that the BV community would speak with ‘one clear voice’ on the issue. Indeed, in this instance poor case law is often the result of bad or weak appraisal work creating poorly informed triers of fact.”

Stay tuned for further details as these events develop!

back to top

Fee pressures, competition among top BV concerns, says BVWire poll

Forty percent of respondents to our recent BVWire poll cite practice management as their biggest concern for 2016 (see chart below). This includes issues such as competition, fee pressures, hiring, succession planning, and the like.

Fee pressures: A number of respondents included comments, and several noted an increased level of competition and a pressure on fees. One insightful comment: “Prospects seem to increasingly focus on the lowest bids under the assumption or misunderstanding that they are buying a commodity product. This problem is compounded by competitors' apparent willingness to undercut one another to win projects. Are there too many valuation professionals chasing too few opportunities?” Another respondent mentions the same issue and offers a suggestion: “Customers will ‘shop’ us all. However, we should be alluding to the specialized nature of the work we perform and should get paid accordingly.”

As for the rest of the survey responses, the second most cited concern is keeping up with developments in the profession (such as new information, continuing education, etc.), cited by 15% of respondents. Expanding into new areas of valuation (including exit planning and litigation) is cited by 12% of respondents, with the rest saying the regulatory and standards compliance (10%) and litigation issues (5%) are their chief concerns. A good number of respondents (19%) chose the “other” category, with the most prevalent answer related to business development and growth.

Full results: Check next week’s BVWire for a link to a complimentary download of the full results and all of the respondents’ comments (which are anonym0ous). Our thanks to all of you who generously responded!

BV practitioners’ biggest concerns for 2016

back to top

PwC must pony up $6 million over inflated valuation

A jury has awarded hedge fund founder Kenneth Lipper $6 million in his lawsuit against PricewaterhouseCoopers over a valuation of his hedge fund, Lipper & Co. According to an article in Law360, Lipper claimed that the valuation was inflated due to “garbage numbers” and cost him $6 million in gift taxes when he gave shares to his daughters.

PwC contended that it should not be on the hook because Lipper knew that one of his executives was systematically overinflating the fund’s securities. That executive pled guilty to fraud in 2003 and was sentenced to six years in prison—but the jury didn't hear about these facts during closing arguments. Lipper contended that he didn’t know about the executive’s actions and PwC should have alerted him about the inflated valuations.

back to top

Alternative energy firms can face huge regulatory risks

A question from the audience during a recent BVR webinar points up a key issue in the valuation of firms that provide energy using alternative sources (e.g., wind, solar). The webinar presenters, Donna Lobete and Rick Daubenspeck (both with BDO Consulting), acknowledge that these firms face an uncertain and potentially high level of regulatory risk. For example, in Nevada, the country’s largest rooftop solar panel installer has been stopped in its tracks by an unfriendly regulatory regime (see this article in Fortune). The company, which was doing land-office business in the sunny desert, has stopped all installations in the state and is laying off 550 workers due to new regulatory changes.

For more information: A recording of the webinar, Alternative Energy—Understanding Critical Business Valuation Issues, is available

here.

back to top

Global BV news:

Worldwide pasta brand values keyed to country’s economic stage

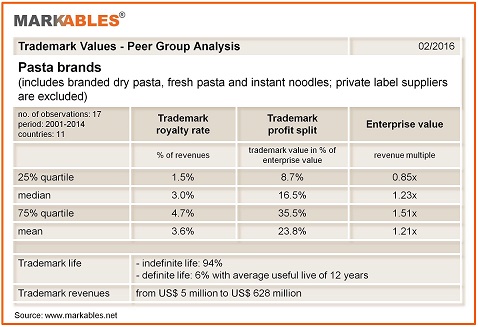

Analysis from Markables reveals some key factors about the trademark valuations of brands of pasta. A sector snapshot and peer group analysis illustrates trademark comparable data for 17 pasta brands from 11 countries. In this sector, trademark royalty rates range from 1.5% to 4.7% of revenues, with a median rate of 3.0%, not very much for fast-moving consumer goods (FMCG) brands (see the chart below). Typically, the remaining useful life is assumed to be indefinite. With these royalty rates, trademark accounts for approx. 20% of enterprise value. Average enterprise value multiples for the sector are 1.25x revenues.

Boiling it down: A closer look at the data reveals some important details. First, trademark valuation multiples are lower in developed economies, where margin pressure from private labels and volume pressure from low-carb nutrition is prevalent, compared with emerging economies. Second, valuation multiples have considerably decreased since the beginning of the millennium, illustrating a change in market conditions and consumer behavior over time. The peer group analysis clearly shows the importance of using in valuations comparable data that is both up-to-date and adjusted for economic stage (developed versus emerging).

Markables, based in Switzerland, has a database of over 6,500 trademark valuations published in financial reporting documents of listed companies from all over the world. The database reports value solely for the use of trademarks (not bundled with other rights).

back to top

|

Preview of the March issue of Business Valuation Update

A fingertip guide to what’s going on in the BV world is a new regular feature in Business Valuation Update. The guide, BV News At-a-Glance, is a quick summary of key developments from the standard setters, regulators, and VPOs, as well as noteworthy new books, research papers, and studies of interest. Plus, of course, the issue includes feature articles that give you cutting-edge food for thought as well as practical “what to do” advice on valuation issues you grapple with every day. Here’s what you’ll see for March:

DLOMs in N.Y. Statutory Fair Value Cases—A Follow-Up to Matthews (William C. Quackenbush, MBA, ASA, MCBA, BCA, ABAR). Comments on an article from the January issue:“NY’s Unfair Application of Shareholder-Level Marketability Discounts,” by Gil Matthews (Sutter Securities). The article struck a new chord in the hot debate over New York's out-of-step position with respect to the discount for lack of marketability in fair value proceedings.

Complications With Event Studies in Securities Litigation (Adrian M. Cowan, Ph.D., and Paul J. Seguin, Ph.D.). An excerpt from a chapter in the upcoming fourth edition of The Comprehensive Guide to Economic Damages, edited by Nancy Fannon and Jonathan Dunitz.

How to Avoid Tripping Up Over Subsequent Events (BVR Editor). David Laro, senior judge of the U.S. Tax Court, talks about the issue of subsequent events. The trick is knowing when you should—and should not—take this information into account in your valuations.

Appraiser Review: How Pratt’s Stats Upgrades Improve Your Search for Comps (Jessica Landay, CVA, and Ron Seigneur, CPA/ABV/CFF, ASA, CVA, CGMA). The Pratt’s Stats transaction database has recently added enhancements to help appraisers identify transactions of companies comparable to the subject company being valued, as well as to better determine comparability of the transacted companies and the subject entity.

Recent Case Points Up Danger of the Discovery Trap (Sylvia Golden, Esq.). In court, troubling documents between the appraiser and the client and attorney fell into the hands of the opposition. In a nutshell, here’s what you need to know to avoid getting into jeopardy.

Seven Tips on Cost of Capital From the AICPA FVS Conference (BVR Editor). Some notable pieces of advice and insights that can kick your cost of capital estimates up a notch—and make them more defensible.

BVU Profile: What Is the Practice of Business Valuation Like in the Middle East? (BVR Editor). An interview with Faisal Alsayrafi, ASA, CVA, CMEA, CPA, founder, president, and CEO of Financial Transaction House (FTH) in Saudi Arabia, which offers a wide range of corporate finance advisory services to a diversified client base in the Middle East.

Regular Features: BV News At-a-Glance, Ask the Experts, and Tip of the Month.

Court Case Digests: Analysis of the latest court cases that involve business valuation issues.

To read these articles and the case digests, see the upcoming March issue of Business Valuation Update (subscription required).

back to top

BV movers . . .

People: Don Barbo has rejoined VMG Health as managing director in the Dallas office … Christopher Lee has joined FTI Consulting Inc. as a managing director of the Transaction Services practice and is based in New York City … Bob Morrison, managing partner of Morrison Valuation & Forensic Services of Orlando, Fla., was elected to a three-year term on the board of directors of Central Florida Zoo & Botanical Gardens … Ronald Pachino has joined PBMares as senior manager in the firm’s Baltimore office … Bryan Seeley, a 21-year veteran of the industrial asset appraisal field, has joined Tiger Valuation Services, a division of Tiger Capital Group, as director, machinery and equipment and will be based in the firm’s New York City office … Ken Wilson, past president and former chair of the policymaking board of directors of the Appraisal Institute, has joined the national real estate appraisal services firm Joseph J. Blake & Associates Inc. as managing director of client relations and business development.

Firms: The Vermont-based A.M. Peisch & Co. acquired Enman & Associates, a Williston, Vt., CPA firm established in 1987 by the sole owner Sandra K. Enman … Miami-based firm MBAF merged in the Palm Beach, Fla., firm Rampell & Rampell … The Chicago firms Prism Healthcare Partners and Principle Valuation completed their planned merger.

back to top

Super lineup of CPE events for February/March

Valuing Specialty Paving Contractors (February 18), with Brad Minor (Blue).

Stop Overvaluing Synergies: Master These Skills (February 23), with Jeff Litvak (FTI Consulting) and Brent Miller (FTI Consulting).

Active and Passive Appreciation: An Empirical Method for a More Accurate Determination (March 8), with Ashok Abbott (West Virginia University).

Valuation in Divorce Litigation: Winning Clients and Testifying in Court (March 15), with Melissa Gragg (BDO USA) and Kristin Zurek (Cordell & Cordell).

Forecasts and Projections for Small Companies (March 17), with George Levie.

Important note to webinar attendees: To ensure that you receive your dial-in instructions to BVR’s training events, please make sure to whitelist bvreducation@bvresources.com.

back to top

|

We welcome your feedback and comments. Contact Andy Dzamba (Executive Editor) or Sylvia Golden (Executive Legal Editor) at:

info@bvresources.com. |